|

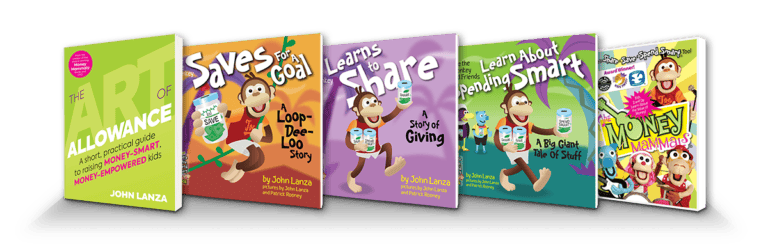

In this issue: Developing an ownership mentality, taking an active approach to investing and preferring a passive portfolio perspective. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! Summer is a great time to begin the investing journey with your kids. And my latest (And returning!) Art of Allowance Podcast guest, Evan Wilson, can help you kickstart your program. Evan is the Host Emeritus of the popular Money JAR Podcast, and he runs Wilson Investment Partnership.

Inspired by our conversation, this week’s edition of “3 Ideas to Share & Save” is all about helping our kids discover what kinds of investors they will become. — 1 — Developing an Ownership Mentality: Stock market guru Peter Lynch famously said, “Buy what you know.” While his advice represents only the first step in the investing process, it’s a sensible filter to help our kids get started. My daughter’s first stock was Adidas because the brand was everywhere we looked in our soccer-drenched lives. Kids are all about obsessions, so we leveraged her current fixation to set up her investing experience. During our chat, Evan explained he wants his kids to take an ownership approach to the stock market — a chance to own a piece of a great business and share in its success. So he helps his kids tune into the real world — like seeing the long line at the McDonald’s drive-thru — to help them discover companies they might want to own. — 2 — An Active Approach Advocate: Evan’s kids have a distinct advantage when it comes to investing. They live with someone who loves the process: How could they not get excited with this passionate perspective? As you can tell from the clip above, Evan’s approach to investing is decidedly active. And I’ve previously discussed the passive (sometimes called the “boring“) approach, for which Popcorn Finance Podcast host Chris Browning advocates. My goal is to provide you with varying viewpoints to help you help your kids begin to discover what types of investors they will eventually become. — 3 — Weekly Wisdom: To cover our bases, our weekly wise words come from Morgan Housel, author of The Psychology of Money and Same as Ever and one of today’s most well-known passive investors. “I am a passive investor optimistic in the world’s ability to generate real economic growth and I’m confident that over the next 30 years that growth will accrue to my investments.”

As I discussed with award-winning investment consultant Will Rainey, time, consistency and patience are key habits we want our kids to develop. And while individual stock picking can seem more exciting, low-fee index funds represent a basket of those same exciting shares with less risk and effort involved. I hope you find Evan’s wise perspective useful as you guide your kids on their investing journeys. By experiencing their own ups and downs, they’ll begin to sort out whether they’ll gravitate towards the excitement of active investing, prefer a passive approach or opt for a mixture of both. And, of course, don’t forget to enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|