|

In this issue: Be wary of overcomplicating financial literacy, tell your kids relateable money stories and some everyday ways to save money. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! Thank you for taking this journey with me as we try to overcome obstacles we encounter on the path to raising money-smart, money-empowered kids. (BTW, if you’d like to hear how previous podcast guests defined the term “money-empowered,” I recorded this short episode with their enlightened answers.) Now let’s dive into this week’s “3 Ideas to Share & Save”! — 1 — Simple Saving: “I don’t think life is that hard. I think we make it hard.”

—Naval Ravikant

One of our daughters texted this question over the weekend: “What are creative tips and tricks to increase saving?” Her college roommate was doing a project, and she wanted our thoughts. (See more of those in Idea #3 below. 👇) So I turned to my wife, Eileen, and suggested we each write our own lists, starting with the fundamentals of saving. We could then share them with each other and later with our daughter and her inquisitive classmate. Honestly, I was curious to see how aligned our lists would be. Not surprisingly, they were closely matched. Our three core savings behaviors are distilled as follows:

Your own list of essential behaviors might differ, but be wary of expanding it too much. Just as research has shown us that multi-tasking basically amounts to “crappy-tasking” on multiple tasks, focusing on too many “core” behaviors runs the risk that none will be heeded. Lists of ten (or even five) ideas start to overwhelm. There’s a paradox of choice that paralyzes us and keeps us from acting as more options become available. Keep. It. Simple. Of course, lists can be helpful when you’re brainstorming ideas to identify the ones you think will work best for your family. See Idea #3. — 2 — Stories Matter: “The best story wins. Not the best idea. Not the right answer. Just whoever tells a story that catches people’s attention and gets them to nod their heads.”

—Morgan Housel

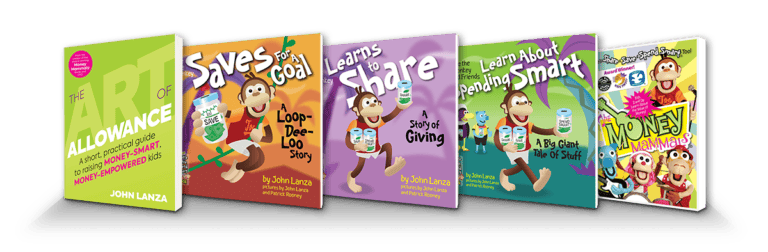

Telling you that your kids enjoy stories is like telling you that they love food. Like food, though, we must find the stories to which they’ll respond. Forcing your wretching toddler to polish off her Brussels sprouts is counterproductive. Perhaps broccoli and peas are the gateway vegetables she needs to develop healthy eating habits. Similarly, we need to identify the characters whose money-smart messages resonate with our kids. Of course, I will start by recommending The Money Mammals’ books and videos. (Incidentally, join one of our credit union partners. You can get complimentary digital versions of all these resources!) Or perhaps podcast guest Will Rainey‘s book, Grandpa’s Fortune Fable$, will kindle your kids’ interest in investing. You could also try the Judith Viorst classic, Alexander, Who Used to Be Rich Last Sunday. The best story does win. Just think about the jingles that play in your head. “I’m cuckoo for Cocoa Puffs” did more than just hardwire a mind virus into my brain; it formed the foundation of the sweet tooth that still haunts me today. 😅🍪🤪 And the original Star Wars trilogy, which I saw when I was seven, continues to be a part of my life. So let’s fill our kids’ brains with great stories. Maybe rather than developing a sweet tooth or deftness with a lightsaber, they’ll forge a savings habit, smart spending skills and a spirit of money generosity. — 3 — Everyday Ways to Save: In The Money Mammals’ original movie, Clara J. Camel outlines her “Reasons to Save.” Channeling Clara’s clear thinking about money, my wife, Eileen, ran with my daughter’s question in Idea #1. (ICYMI, Eileen co-created The Money Mammals with me and really is our family’s money-smart O.G. She’s even appeared on the podcast!) Please use her list of tips and tactics to find ideas that resonate with your kids on their money-smart journeys.

As always, remember to enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|