Money-Smart Mondaywith John Lanza Hello, friends, I’m bringing you some tasty tidbits this week. I built a new component using the knowledge from this course and an assist from ChatGPT. So now I can easily share Art of Allowance Podcast audio shorts like the ones below. I hope you enjoy tuning in! Perspective(s) on starting an allowanceDavid Owen wrote The First National Bank of Dad. And while on the podcast, he shared essential advice about how to incorporate chores into your allowance system. Click here to listen to his perspective as a dad who has been down the path with his two kids (now productive adults). One of the joys of hosting my podcast is that I hear multiple viewpoints on raising money-smart kids. As the saying goes, “Personal finance is personal.” So while I tend to agree with Owen’s thinking that you don’t need to tie chores to allowance, James Robert Lay offered an alternative “entreprenerial” take that might appeal more to you and your family. Essential advice for our adult kidsA 401(k) is NOT an investment! Neither is an IRA. The money in these “containers” must be invested in mutual funds, stocks or bonds. While these observations will sound obvious to most readers of this newsletter, a Vanguard study recounted two-thirds of employees had no idea they were entirely in a money-market fund. Whoa! As my guest Bobbi Rebell pointed out in this short snippet from our discussion, we need to continue the money conversation with our adult kids so they don’t make this same mistake. Because money mistakes aren’t just for kids. My wife discovered that a friend (In her mid-fifties!) let the 529 college savings account she set up sit in cash. What a double whammy! By not investing this money in a total stock market index fund, the family missed out on the big gains of the past decade and a half. Meanwhile, interest rates on cash accounts during the same time were awful. Ouch! Advice I’m pondering“Too often, the people we ask for feedback are nice but not kind. Kind people will tell you things a nice person will not. A kind person will tell you that you have spinach on your teeth. A nice person won’t because it’s uncomfortable. A kind person will tell us what holds us back, even when it’s uncomfortable. A nice person avoids giving us critical feedback because they’re worried about hurting our feelings. No wonder we think other people will be interested in our excuses.”

—Shane Parrish, Clear Thinking

Am I being nice or kind with money advice for my kids? Wise words from a wise man“Teaching our kids to be investors and not speculators is a key role for parents.”

—John C. Bogle, Enough

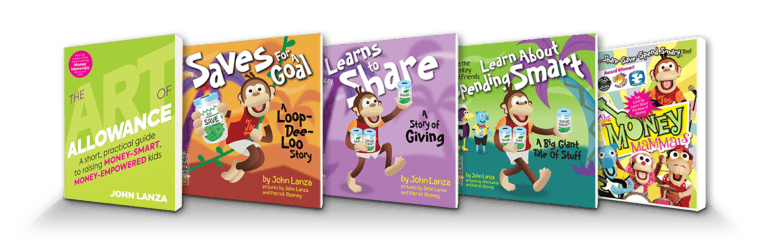

Bogle knows what he’s talking about. He founded Vanguard and is credited with creating the modern mutual fund industry. More ideas I found interesting➡️ Desire can delude us. (audio) I appreciate your time each week. Spreading these messages is the best way to support this work. If you like what you read or hear in my newsletters, I hope you will share it with others. As always, enjoy the journey! John,

📗 Get The Art of Allowance (for parents) P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being. Forwarded this email? Sign up here. |