|

In this issue: The importance of spending smart, learning financial lessons through experiences and sharing our money stories. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! In case you missed this post from my podcast guest Will Rainey‘s LinkedIn page, I had to share:

It’s a good visual reminder that however much you have, there’s always someone with more. In our world, striving is celebrated, and contentment is underrated. And with that, welcome to “3 {More} Ideas to Share & Save”! — 1 — “Buy Good Things”: When my wife’s Patagonia jacket tore slightly at a seam, she went to their local retail store. They replaced it, no questions asked. So she received a brand new $200 jacket at no additional cost. While I was pleasantly surprised, I wasn’t shocked after having recently listened to a Founders Podcast episode featuring the company’s customer-focused, mission-driven founder, Yvon Chouinard. So when the zipper on my Goodwill-purchased fleece gave out, I looked at Patagonia. I found a jacket I loved, though I didn’t love the $120 price. (That was 10 times more than I paid for the used fleece I was now replacing! 😲) Then it dawned on me: If I bought Patagonia, I might never need another coat. I’m wearing the jacket as I write this email. Carl Richards, a financial expert and the author of The Behavior Gap, tells a similar story about value in a recent post titled “Buy Good Things.” In it, Carl explains that he could have “saved” money by choosing Walmart’s $50 ski pants rather than $300 Moonstone ones. However, years later, he still has his Moonstones, and they’re still his family’s favorite ski clothes. We want to teach our kids to spend smart. Of course, that includes searching for bargains and calculating unit prices in the supermarket. It can also mean introducing our kids to thrift shopping when they’re young. But we mustn’t forget to emphasize the importance of quality products from proven brands: “So save up until you can buy the nice thing once. I know it hurts at first…but trust me, in the long run, it’s worth it.”

—Carl Richards

— 2 — Weekly Wisdom: In her wonderful book How to Raise an Adult, Julie Lythcott-Haims advocates for our kids to learn hard-won lessons through their own experiences. “Allowing freedom within limits to try and fail and get better is the only way children (or anyone) will ever learn how to do things for themselves. Perfectionism is not only the enemy of the good; it is the enemy of adulthood.”

—Julie Lythcott-Haims

I’ve shared my idea with you that our kids’ financial education machines are powered by three engines: instruction, modeling and experience. Experience is the one from which they are most likely to learn the lessons that stick. So we can wax poetic about how our possessions tend to own us rather than vice versa, but our kids have to discover whether what we say works for them. No amount of stock simulations can replace that heart-wrenching feeling of the company you invest in going bankrupt. (Yep. Happened to me. 😐) Or the pain of paying seemingly endless monthly interest charges for that computer purchased on credit. (Yep. Also happened. 😬) We sometimes equate mistakes like these with failure. If you feel that way, try pairing Lythcott-Haims’ perspective with Kobe Bryant’s in this 5-minute video: — 3 — Share Your Story: I’m looking for great stories I can share on upcoming podcast episodes. Here’s a fun one from my book, The Art of Allowance:

“I want to play with Charity. She has all my toys.” Our daughter actually uttered this statement. On our way back from the donation center where we had donated a big bag of her old toys, our then three-year-old innocently peered at me in the mirror and shared her desire. We had instituted our family plan to combat the accumulation of stuff. For every new birthday present received, one old item had to go. This practice satisfied both my inner Marie Kondo and our limited-space issue.

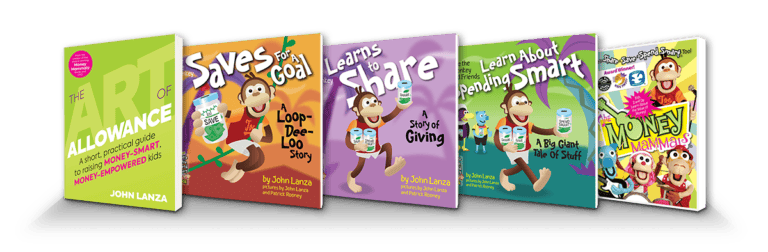

And here’s an anecdote from podcast guest Chelsea Brennan: Do you have a money story you want to share? Did your kids do something that made you proud, worried or laugh? Please reply to this email with your tale! We’re on this money-smart adventure together, and sharing our stories is integral to improvement. As always, enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|