Hi there, credit union friends,

If you’re a regular recipient of email messages from me, then you’ve probably realized I like to refer to Thursday as “Friday Eve.” It’s my way of celebrating the penultimate day of the work week.

But today, we have more to celebrate than being one step closer to the weekend. It’s also International Credit Union Day®! 🥳

Banking on each other: This year’s theme is “One World Through Cooperative Finance.”

So in the words of Joe the Monkey, “Blazin’ Bananas!” Let’s get right to this special edition of “Marketing Manatee Musings,” which highlights the impact we in the credit union movement are making together.

— 1 —

Ready to {Cap}Rock: To kick off today’s festivities, we’re welcoming a new partner! Caprock Federal Credit Union serves five counties across West Texas. And fortuitously, their leadership heard about us through their involvement with the Cornerstone Foundation, for whom we are a “Preferred Financial Wellness Service Provider.”

(Fun fact: If your institution is part of the Cornerstone League, then you can apply for a grant to bring our program to your members! 🙌)

Caprock rolled out The Art of Allowance Project in two phases. Their summer soft launch allowed them to leverage the program’s digital and educational resources for their community outreach efforts. Then as a back-to-school bonus, they introduced their members to the full family financial wellness platform featuring The Money Mammals for young children and Adolescent$ for tweens and teens. This program not only engages kids of all ages but also empowers parents to be their children’s guides on the money-smart journey. And what’s more, it helps further amplify the credit union’s approach to member relations, which is to “offer something a little more special.”

Here’s what CEO Dale Hansard had to say about our partnership:

“At Caprock FCU, we believe that financial literacy starts at a young age. Through this collaboration, we’re offering fun and engaging resources to help parents teach their kids about money management, saving, and spending wisely. The goal is to create financially savvy kids who grow up to be empowered, responsible adults.”

And we continue to work closely with Dale and the rest of the Caprock team. Specifically:

- We’ve onboarded key personnel; walked them through the member-focused, white-labeled Art of Allowance Project digital content; and shared our robust backend resources and marketing materials that promote and support the program.

- We’ve helped them launch the platform by curating an order of customized offerings to provide to their members, like birthday postcards, character stickers, and quarterly newsletters.

- We’ll follow up with regular check-ins to help them continue to grow the program.

If, like Caprock, you’d like to engage kids and empower parents with The Art of Allowance Project, then let’s chat! Our nationwide network of credit unions recognizes that financial wellness solutions such as ours benefit both members and employees. So book a time here if you want to learn more about how we can help you help these individuals on their money-smart journeys.

— 2 —

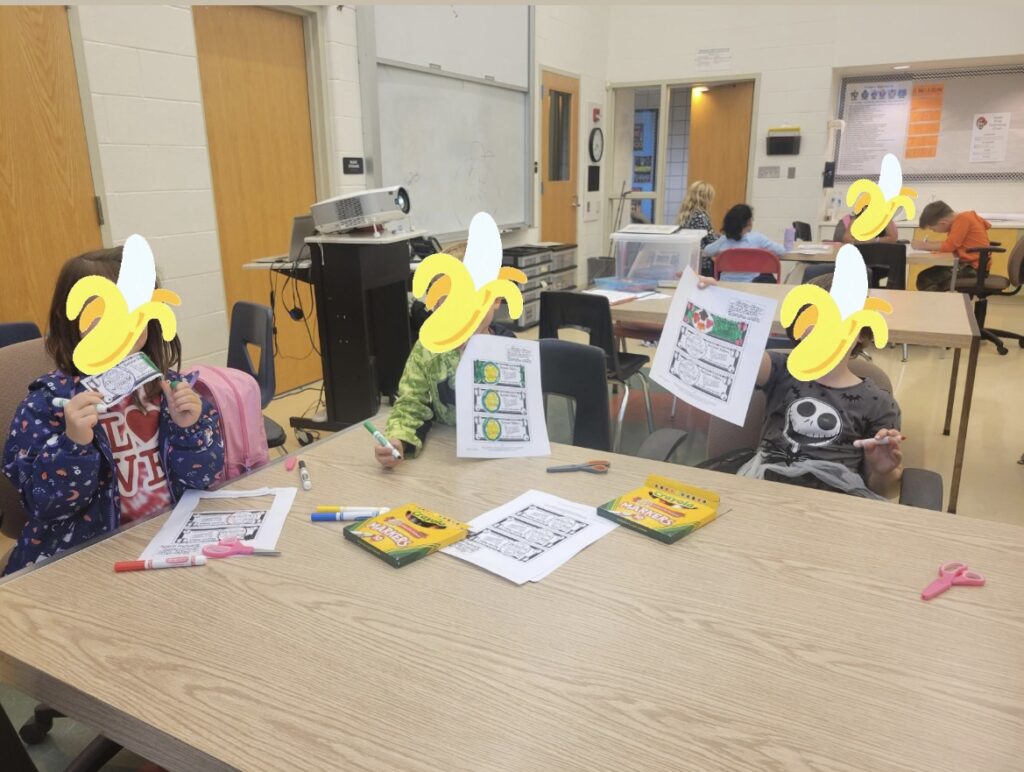

Kickin’ It After School: Cue the confetti for Northern Illinois-based Great Lakes Credit Union! 🎊 This institution continues to grow its youth community activation series, which features a partnership with an after-care program at a local elementary school.

During 45-minute weekly sessions, members of the Great Lakes “Great Wave” volunteer team spread the money-smart message to Kindergarten through 3rd Grade students with the help of The Money Mammals’ suite of educational resources. These miniature money mavens determined how they could earn some extra bucks, learned about setting and saving for goals, and even colored their own “Decision Dollars” when discussing opportunity costs.

The 8-week program culminated in a field trip to a nearby Great Lakes branch, where The Money Mammals’ own Piggs the Bank served as host. Several participating students and their family members even opened accounts that day!

Regarding the value of youth initiatives like this one, Great Lakes Community Outreach Specialist Makenzie Marsell attests:

“Our Money Mammals Outreach has had huge impacts on our students and their families. Parents have made comments about their children being able to understand wants and needs when they are out grocery shopping and saving their allowances for bigger things rather than spending it right away. Partners have requested us to do part 2’s, and the Emmons students wanted to continue with more sessions after the 8-week series was over. All of our partners who have had a session have immediately asked for us to continue or offer again to impact more students.”

“Wave” to go, Great Lakes!

— 3 —

Three’s Company: No International Credit Union Day® celebration would be complete without party favors! So read on for a sneak peek of three special episodes of The Art of Allowance Podcast we’ve released over the past month.

1️⃣ Chief Mammal John Lanza teams up with Stacking Benjamins Podcast co-host Joe Saul-Sehy to interview author Jon Acuff. These three dads discuss parenting challenges, like teaching teens money and life skills. They also explore the importance of empathy when parenting, the role of repetition in financial education, and the value of kids’ seeking guidance from other adults.

You and your members can tune in to their full conversation here. Or for a preview of their chat, stream the following short. In it, Jon provides parents with “illuminating” career advice they can give their kids.

2️⃣ In honor of Cybersecurity Awareness Month, John speaks with digital literacy advocate Diana Graber about strategies for raising kids in a constantly connected world. The two talk about understanding children’s developmental readiness for technology, emphasizing ethical thinking in digital spaces and balancing the risks and the benefits of an online presence.

Use this link to give this episode a listen. You may also want to share the following snippet, in which Diana outlines online scams teens should avoid, with your membership.

(A Piggs the Bank “Sweet Swine!” to Amanda Hullinger, the Director of Marketing of our partner, Georgia United Credit Union, for requesting this topic be added to our ever-growing content library.)

3️⃣ Dropping today is John’s conversation with Courtney Fulmer, the newly appointed President/Chief Executive Officer of SECNY Federal Credit Union. They discuss how credit unions can combat America’s “financial illiteracy epidemic” by understanding the role these institutions play in providing psychological support to members. Additionally, Courtney shares stories from her family’s own money-smart journey.

Round out your International Credit Union Day® festivities by pressing play on Courtney’s episode here. And the following clip, in which Courtney reveals how financial literacy can fail, is a must-watch!

Well, credit union friends, I hope you’ve enjoyed this celebration of our mighty movement. And as always, but especially today, I applaud your commitment to the philosophy of “people helping people.” 👏

Now it’s full fin lit flippers ahead to Spooky Season!

📸: Tostoini on Giphy

Until next time,

Erin Prim

Marketing Manatee