|

In this issue: Emphasizing charitable giving with kids, dispelling thoughts of money shame and describing “good debt.” “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! I recently enjoyed turning the mic on fellow podcaster and money maven Andy Hill. I’m excited to share our full conversation, which dropped today. I have a favor to ask. When you listen in via your chosen streaming app, please follow, like or subscribe to the show. This will help more folks find it, help me bring on more great guests like Andy and help our money-smart movement move forward.

And did you know we write copious notes for each episode to help you easily find topics of interest? (Just take a look at the wide range of subjects Andy and I covered during our discussion.)

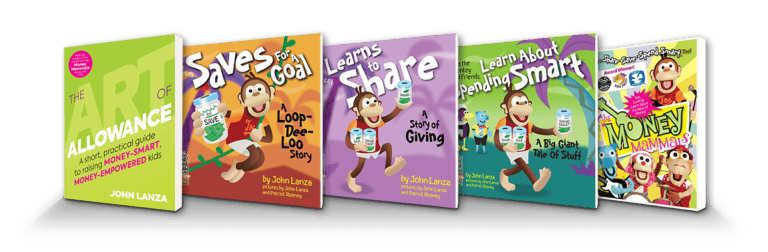

Ok, that’s enough housekeeping. Now on to this week’s “3 Ideas to Share & Save” inspired by my conversation with Andy! — 1 — The Family Sharing Journey: Andy emphasizes charitable giving with his kids. Generosity is a key Hill family value, and he built his allowance to ensure his kids would consistently contribute to their Share jars. But when Andy looked at his own giving behavior, he noticed a disconnect between his talk and his walk. (If there’s one thing we can all agree on, it’s that we don’t want our kids to see us as hypocrites.) So he decided to take a different path on his money-smart journey: Curious about the three-jar system that we often mention here? You can find out more in this post, this video or my book, The Art of Allowance.

— 2 — No One Right Way: Perhaps the biggest mistake we can make is thinking we don’t have something to offer our kids when it comes to teaching money smarts. Because no matter our previous money baggage, shame or missteps, as Andy explains, we all have something to share: So get started with that conversation! And if you run into a question, email me. (Seriously!) I’ll get back to you with a video, post or podcast, or I’ll simply send you a response. And if your question is a stumper, I’ll reach out to my vast network of money-smart mavens to find you an answer. Who knows … you might inspire my next podcast! — 3 — Weekly Wisdom: “Once you get into debt, it’s hell to get out. Don’t let credit card debt carry over. You can’t get ahead paying eighteen percent.”

—Charlie Munger

Andy famously journeyed from debt to financial freedom in one year. So I wanted to know how he might describe a term I hear a lot — “good debt.” And though Andy’s interest rates were nowhere near the percentage in Charlie Munger’s warning above, their insights align: If you enjoyed my conversation with Andy this week, you might also like our discussion on his podcast several years ago. And as always, don’t forget to enjoy the journey! John, P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

View this email in your browser. Forwarded this email? Sign up here.

|