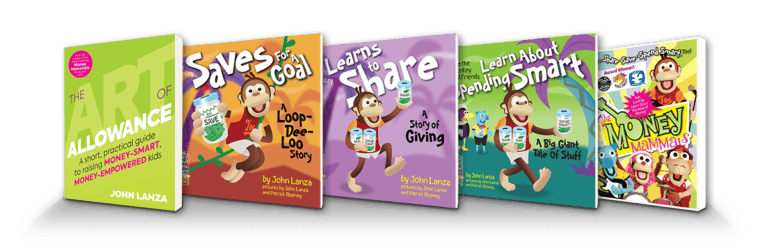

Money-Smart Mondaywith John Lanza Hello, friends, We are actively seeking credit unions to join our growing list of incredible partners, like Community Choice in Iowa. (Here’s their story about how the Money Mammals program has helped them make a difference.) If you want to become a partner, please ping me back. And now I present the act you’ve known for all these years, Money-Smart Monday! An approach I wish I’d incorporatedPodcast guest Andy Hill shares an important insight he uncovered on his family’s money-smart journey. Like many of us, Andy flipped what felt like hypocrisy — requiring his daughter to give ten percent of her money to charity while realizing he and his wife were giving a smaller percentage — into a productive change to his own finances. In this short clip, Andy walks us down the path to increasing his charitable donations yearly until matching the rate at which his kids give. I wrote a fun picture book, Joe the Monkey Learns to Share, about helping children find a charity that is personal to them. (You can get the book here.) If I’m honest with myself, though, we I could have done a better job modeling the Share jar. So relayng Andy’s inspiring story is a form of penance. An idea I keep coming back toAuthor Sahil Bloom’s recent article reminds us that finding someone we genuinely enjoy spending time with is essential. Despite what Instagram tries to tell us, life isn’t about the glamorous moments. While our visit to the Duomo may create a little FOMO, much of our existence is spent sitting around doing nothing. Historians Will and Ariel Durant alighted on a similar insight in their wonderful little book, The Lessons of History. “Life is mostly boring. Behind the red facade of war and politics, misfortune and poverty, adultery and divorce, murder and suicide, were millions of orderly homes, devoted marriages, men and women kindly and affectionate, troubled and happy with children.”

The happiness study we often misinterpretYou’ve probably heard of the 2010 happiness study co-authored and popularized by the brilliant Daniel Kahneman. It affirms our emotional well-being doesn’t increase with an income above $75,000. That amount sounded surprisingly low and made for a good headline. It was misconstrued to mean that making more money didn’t matter to our emotional health. Turns out that interpretation wasn’t entirely true. From the study: “We conclude that high income buys life satisfaction but not happiness, and that low income is associated both with low life evaluation and low emotional well-being.”

It turns out that a second critical component — life evaluation (or satisfaction) — contributes to our overall emotional health. And it tracks with an income well above the $75,000 threshold. (Listen as Paul Bloom and Sam Harris discuss.) I prefer the term “fulfillment” to “happiness” because the former better identifies what we seek. We want to enjoy our lives moment-to-moment (happiness) but also look back and feel like they had meaning (life satisfaction). Both actions bring us fulfillment. So while we know money can’t buy us happiness, the study underscores the reality that we need to make money to live fulfilling lives. And discovering what amount of money each of us needs matters a lot, highlighting the importance of getting our kids started on money-smart journeys early. It’s only through our individual experiences that we discover how saving, spending and sharing make us feel. We all leverage these experiences to begin to use money as a tool to craft fulfilling lives. More ideas I found interesting➡️ The Tooth Fairy is on a budget John,

📗 Get The Art of Allowance (for parents) P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being. Forwarded this email? Sign up here. |