|

In this issue: Establishing the goal of allowance, deciding when to introduce digital money and acknowledging “nexting.” “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! Here are three “cool” ideas to help you weather these dog days of summer. 🥵 Let’s get right to it so you can return to your porch to get your hands on a cold glass of iced tea. — 1 — Doing Allowance: “The greatest teacher is called ‘doing.'”

—Kevin Kelly, Excellent Advice for Living

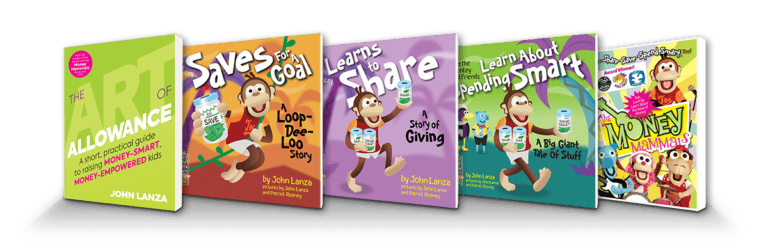

Art of Allowance Podcast guest Chelsea Brennan brings a refreshingly clear approach to raising money-smart kids. While I encourage you to listen to our full conversation, I want to spotlight an important point as you’re working on your allowance programs this summer: As Chelsea explains, money in the bank is not the goal. Rather, experience with “the green stuff” is. 💵 And during her second podcast appearance, family money researcher Ashley LeBaron-Black affirms that research supports Chelsea’s stance:

— 2 — Doing Debit Early: Talking to money experts and parents (And often both!) on the podcast has opened my eyes to many interesting tips and tactics. So much of this newsletter is dedicated to sharing these ideas with you. And along the way, I realized that I don’t have to agree with a strategy to share it. For example, Chelsea, the clear-thinking Smart Money Mama I mentioned above, started her kids with digital cards young. Very young. Yes, you heard that right. Four years old! 🤯 And Chelsea’s reasoning was sound. With “consistency” as an allowance watchword, her delving into digital allowance with automated distribution made perfect sense for her family. I’m not sure I’d structure my system differently if my kids were the same ages as Chelsea’s children are now. I liked distributing physical dollars to them each week. Doing so helped emphasize the choices they were making to share, save and spend smart. I also liked having my kids engage in physical transactions. Young children have a difficult time dealing with abstractions like digital purchases, so it’s useful for them to see real money being exchanged. But of course, digital money is real money. So kids eventually need to learn to use it. The key point is that both approaches have merit. You can decide what will work best for your family. If you routinely miss allowance payouts because you don’t have cash in your pocket, you may want to automate early like Chelsea did. But if you want to leverage the research that says humans are more reluctant to part with physical money versus digital funds, you might delay the transition from cash to card. That’s what makes this the Art of Allowance.

— 3 — Weekly Wisdom: “There’s this “nexting” thing where you’re sitting in one spot thinking about where you should be next. It’s always the next thing, then the next thing, the next thing after that, then the next thing after that creating this pervasive anxiety.”

—Naval Ravikant

Maybe our kids’ (or our own 🙈) texting habits aren’t the problem. Perhaps less “nexting” might help us all enjoy the journey. John, P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

View this email in your browser. Forwarded this email? Sign up here.

|