|

In this issue: How credit unions help families become money-empowered, how “paying yourself first” transcends money and how “being” differs from “becoming.” “Helping parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! For nearly two decades, we’ve been helping credit unions engage kids and empower parents. So I’m excited to share what I learned from my latest podcast discussion with Courtney Fulmer, the recently promoted President and CEO of SECNY Federal Credit Union. SECNY is a long-time Money Mammals and Art of Allowance Project partner. And it is lucky to have Courtney, who is both a money expert and a parent, at its helm. As you’ll soon discover, she is wise beyond her years.

Please cue up our conversation in your podcast player. And while you’re at it, I’d appreciate your rating or reviewing the show. (Reviews really do help me get great guests, like Courtney, on the podcast. Thanks! 😃)

— 1 — All the Places We Go: During her appearance, Courtney and I discuss how she’s raising a money-smart son and the role credit unions play in helping families become money-empowered. While I hope you listen to or watch our full conversation, below are handy links to jump directly to the parts of our discussion that most interest you. (Just click on the time stamps.)

— 2 — Hop on Pop Pop: You’ve likely heard the money-smart maxim to “pay yourself first.” Courtney’s broader interpretation of the phrase, to which her Pop Pop introduced her, is insightful. Courtney’s thoughts align with what we’re doing here — teaching our kids to use money as a tool instead of as an end. Paying ourselves first in time, experience and other non-monetary benefits parallels this point. — 3 — Weekly Wisdom: I’m sharing two bits of wisdom this week — one written and one pictorial. “Being is very different than becoming…We often find out that what we thought we wanted before we got it is no longer what we really want once we have it.”

—Jason Zweig, Your Money & Your Brain

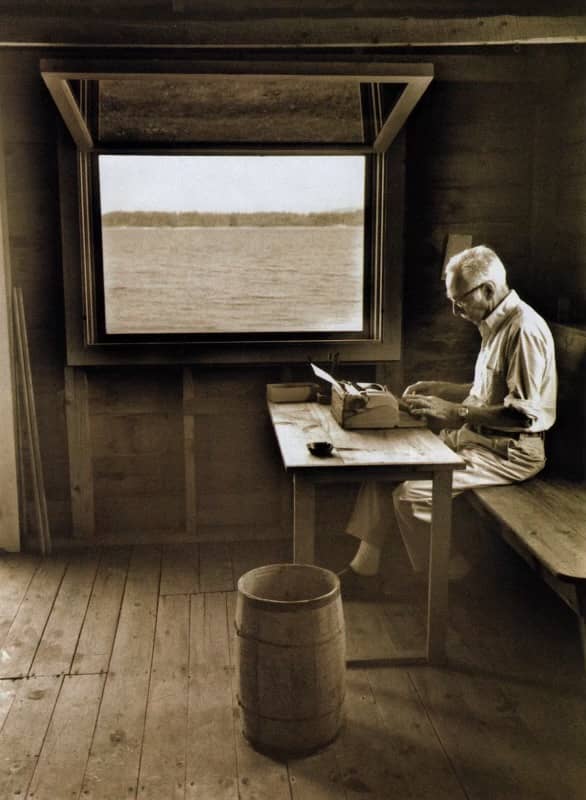

I also love this picture of writer E.B. White, author of Charlotte’s Web, Stuart Little and many other beautiful books, enjoying his journey. It is a study in craft and emphasizes the notion that you don’t need much stuff to make something great.

As always, enjoy your own journey! John, P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

View this email in your browser. Forwarded this email? Sign up here.

|