Hi there, credit union friends,

Have you ever had the “pleasure” of helping a child assemble Valentines for their classmates or friends? As the mom of a preschooler, I can say that it’s a tough choice between including a treat or a toy. This year we went the toy route, as my daughter selected lightning bug-themed cards with glow stick accessories:

And on Valentine’s Day, she bounded out of daycare with a bag brimming with goodies. From lollipops attached to hand-scribbled notes to curated containers featuring mini LEGO sets, she was just as excited to open one prize as she was to reach for the next. Each engaged her in its own unique way, and she had quite the “lovely” night interacting with them all.

In a similar fashion, this newsletter serves as a money-smart grab bag of sorts. The strategies included in every edition range from simple to spectacular. But they all share the same purpose: to engage kids on their journeys to money empowerment. So let’s open this month’s installment to see what’s inside!

— 1 —

All in the {Maine} Family: Earlier this month, we welcomed a new partner into what I lovingly refer to as “The Money Mammals Menagerie.” Maine Family Federal Credit Union calls Androscoggin County home and has branches located in Auburn and Lewiston. (Fun fact: Our Chief Mammal, John Lanza, is an alum of Bates College, which is located in Lewiston!)

On February 1st, Maine Family launched The Art of Allowance Project family financial wellness program featuring The Money Mammals for young children and Adolescent$ for tweens and teens. This robust platform not only engages kids of all ages but also empowers parents to be their children’s guides on the money-smart journey. And what’s more, it helps further amplify the credit union’s approach to member relations, which is “Experience the Feeling of Family.”

Here’s what CEO Daniel Clarke had to say about our partnership:

“Having worked with John and the Money Mammals at another credit union prior to arriving at Maine Family, I knew that this was a brand that resonated with children. When I saw the Money Mammals live at a school and the reaction of the kids to Joe the Monkey, I knew this was a program to jump-start our youth savings program.”

To ensure a successful rollout, we continue to work closely with Daniel and the rest of the Maine Family team. Specifically:

1️⃣ We’ve onboarded key personnel and walked them through the white-labeled digital content they now offer their members. We’ve also shared our robust backend resources and marketing materials they can leverage to promote and support the program.

2️⃣ We’ve helped them prepare to launch the program by curating an order of customized offerings to provide their members, like birthday postcards, mini fun books and quarterly newsletters.

3️⃣ We’ll follow up with regular check-ins to help them continue to grow the program.

If, like Maine Family, you’d like to engage kids and empower parents with The Art of Allowance Project, and you’re not already a partner, then let’s chat! Our nationwide network of credit unions recognizes that financial wellness solutions such as ours benefit both members and employees. So book a time here if you want to learn more about how we can help you help these individuals on their money-smart journeys.

— 2 —

Getting Schooled on Financial Education: In the latest episode of The Art of Allowance Podcast, John tackles the topic of youth financial education with Vince Shorb, the CEO of the National Financial Educators Council (NFEC).

During the discussion, Vince shares profound insights on the pivotal role parents play in financial literacy and the need for comprehensive school programs at all grade levels. Here are some highlights:

- Three important behaviors kids should practice to help them become money-smart adults

- Why we’re failing children in terms of financial education in schools

- The importance of empowering parents on the money-smart journey

For more on this last topic, watch the video short below. In it, Vince helps us rethink what a school’s role in financial literacy learning might be.

You can stream Vince’s full episode here. It is a must-listen for credit union innovators seeking strategies to enhance financial education initiatives. Vince’s experience developing impactful programs (Over 2,500! 🤯) at the NFEC allows him to offer valuable lessons on engaging communities and empowering families with financial wisdom.

— 3 —

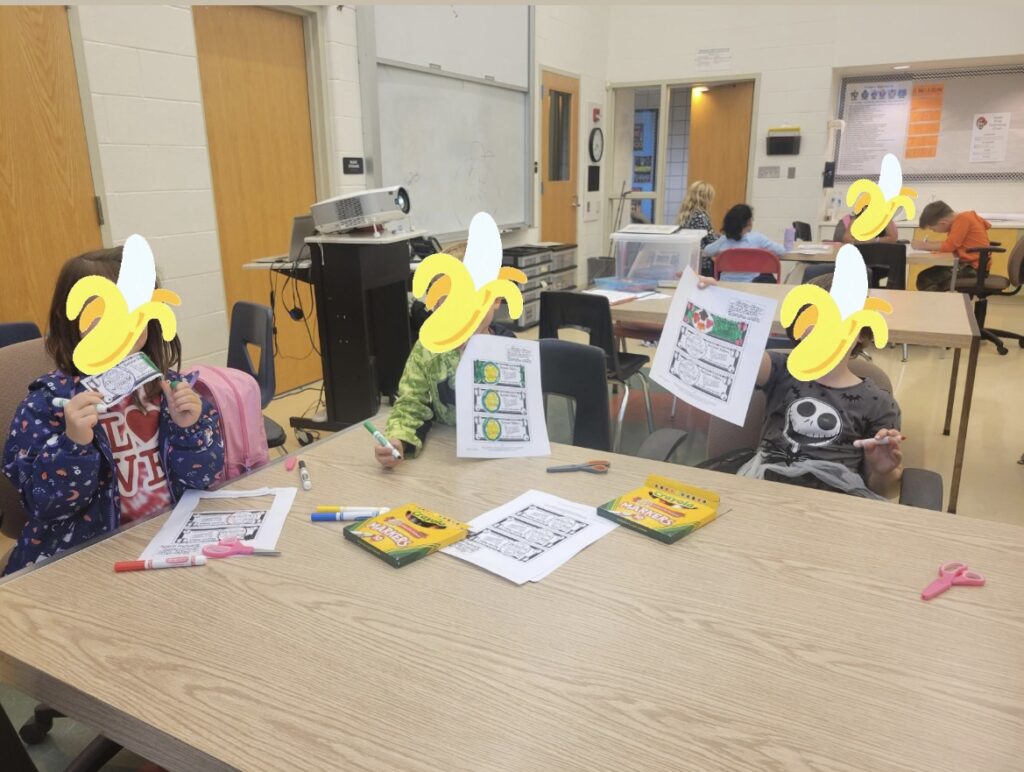

Kickin’ It After School: This month’s gold star goes to Northern Illinois-based Great Lakes Credit Union. This institution currently has three youth community activation series in progress, one of which is a partnership with an after-care program at a local elementary school.

During the 45-minute weekly sessions, members of the Great Lakes “Great Wave” volunteer team spread the money-smart message to students in Kindergarten through 3rd Grade with the help of The Money Mammals’ suite of educational resources. These miniature money mavens determined how they could earn some extra green stuff, learned about setting and saving for goals, and even colored their own “Decision Dollars” to use when discussing opportunity costs.

The 8-week program culminated in a field trip to a nearby Great Lakes branch. This event was attended by participating students and their families, several of whom opened accounts the same day.

Regarding the value of youth initiatives like this one, Great Lakes Community Outreach Specialist Makenzie Marsell attests:

“Our Money Mammals Outreach has had huge impacts on our students and their families. Parents have made comments about their children being able to understand wants and needs when they are out grocery shopping and saving their allowances for bigger things rather than spending it right away. Partners have requested us to do part 2’s, and the Emmons students wanted to continue with more sessions after the 8-week series was over. All of our partners who have had a session have immediately asked for us to continue or offer again to impact more students.”

“Wave” to go, Great Lakes! 👏

Well, friends, we’ve reached the bottom of this month’s money-smart grab bag. Feel free to take with you the tactics that will benefit your institution. And don’t forget to share with me the strategies you’re leveraging to engage your young members and their families.

Until next time, here’s to putting our best fin lit flippers forward!

Erin Prim

Marketing Manatee