I remember thinking to myself, “How could you not know this?” I was a sophomore Teacher’s Assistant (TA) in the Bates College Freshman Biology lab. One of the students had asked me a question about invertebrate heart development that I couldn’t answer. I turned to Dr. P. because surely he would know. He was the professor, after all. Dr. P. looked at me and then shifted his gaze to the massive textbook. “I don’t know.” He smiled. “Let’s look in the book.” With a few deft flips of his finger, he found the answer. This simple process opened my eyes.

Dr. P. may have been the lecturer, but he was a geneticist. Had the question been about Gregor Mendel’s peas or telomere structure, also briefly covered in the course, he wouldn’t have required assistance. But anatomy? Fish hearts? That was another story. I’m not proud that my first thought was roughly, “This guy is a total charlatan teaching Intro Bio and he doesn’t know the basics.” Keep in mind that the book was roughly the size of the Bible. I realized that save for a few folks blessed with photographic memories, no one could know the entire contents of that text.

Though I was at first uneasy with Dr. P.’s lack of omniscience, his comfort with it was empowering for me to see. He figured out how to obtain the answer without pretense. Not knowing was okay. The process of learning and discovery mattered more than any cold, hard facts.

When your tween is ready to take the next step in his or her money-smart development on the path to becoming money-empowered, you will soon realize that you don’t have all the answers. Worse yet, so will she! It will be time for her to graduate from the simpler three-jar allowance that I outline in The Art of Allowance to the new Breakthrough Allowance. Try to channel Dr. P. in this process, and allow your vulnerability—the fact that you can’t possibly know everything—to guide the way you embrace the practice of raising money-smart kids.

Here’s how I describe this next step within the journey of raising money-smart, money-empowered kids in my book:

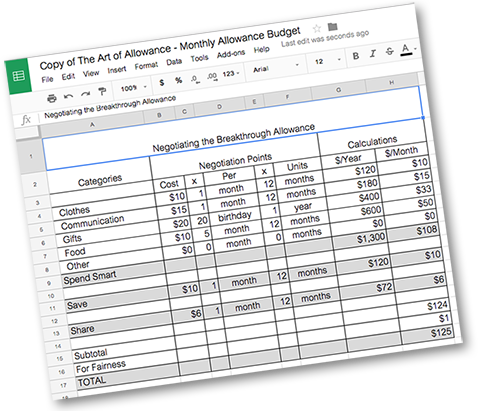

Your tween or teen is now ready for the Breakthrough Allowance, a major developmental step. She’s moving past the starter allowance detailed earlier. Her responsibilities will increase substantially. She’ll create a yearly spending plan, and her allowance intervals will change. You may even decide to incorporate a digital allowance as I explain below.

Since she is “graduating” from her starter allowance, a little celebration might be in order. Before she embarks on the next stage of this journey, commend her for the progress she’s made in learning the three core money-smart skills: saving for goals, making smart money choices and distinguishing needs from wants. Let her know this step is a meaningful milestone.

There are some obvious areas of responsibility for your burgeoning money maven: clothes, communication, gifts and food. Don’t let the “food” category scare you. I’m talking about bringing versus buying school lunch, not raising her own farm animals. (Although that undertaking would certainly teach her responsibility.)

You’ll be increasing her total allowance amount substantially to accommodate for these new areas of control. The additional responsibilities of clothes, communication, gifts and food all belong in the Spend Smart domain. This time is a good one to consider using a digital allowance like the options offered via FamZoo or FamilyMint. (Links are available at theartofallowance.com.)

A digital allowance enables you to automate the allowance distribution process into virtual “jars.” You can also automate interest and matching. Part of her progression to becoming money- empowered is learning how to become digitally money-smart. Though a digital allowance simplifies the process, automation is silent, and you’ll want to make sure you continue the money conversation with your child.

I suggest you continue to nudge or mandate an “opt-in” to the Share and Save jars (real or virtual). You may decide to give her free reign, but with the increase in responsibility, keeping those nudges in place is probably a good idea. In fact, if you employ a digital allowance, then you can teach her the power of automatic deposits into Share and Save accounts so that she never sees—and isn’t tempted by—the money in her discretionary Spend Smart account.

Also, the overall percentage of the Share and Save “opt-in” contributions will likely go down, as she’ll be controlling much more discretionary income with the Breakthrough Allowance. Of course, it’s your Art of Allowance, and you may mandate larger chunks of money for either the Share or Save jars or for both.

You can get the Breakthrough Allowance spreadsheet on our Parents’ Resources page. (Click here)

Just as I discovered with my students as a TA, your kids may ask you more difficult questions commensurate with their growing money responsibility. Like Dr. P., it’s important to recognize what you do and don’t know and to provide support accordingly during the money-smart teaching journey. If you’re not a budgeter and prefer to track spending and adjust based on trends, then you may not want to offer up “expert” budgeting advice. We should all tell ourselves that it’s okay when we don’t have a ready answer. We can help our kids figure out the next step in the journey even if the immediate path is obscured. Let’s just take that next step.

Try to embrace the autonomy your children are constantly clamouring to wrest from you. I say “try” because just this past weekend when we attempted to sign up our 12-year-old for the second year of a progressive engineering program offered at her school, she quipped, “It’s boring. I did it last year. You can’t just make choices for me that I don’t want.” So, I know that it’s much easier for me to ask you to “embrace the autonomy” than it is for you to follow through with your own kin. However, I believe that the reward is still worth the effort.

Of course, there are many more details about allowances for teens and tweens in my book, The Art of Allowance, as well as additional resources to help you raise money-smart, money-empowered kids at themoneymammals.com.

As always, I wish you luck on your journey.

— John