|

In this issue: How kids learn about money smarts, the relationship between earning and spending and types of conspicuous consumption. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! Boy, do I have a juicy issue for you today. My newest podcast episode features my first discussion with a money-smart AI, Buyitt McSpendthrift, who shares its unique take on financial “wellness.”

We cover a ton of digital ground in our wide-ranging conversation. Want to accumulate more stuff than your parents? Live high on the hog? Move those goal posts? Buyitt has the answers. It also explains how we can “Keep Up with the Joneses” and why an allowance is an absolute folly. So put that coffee down! ☕️ You don’t want to miss a minute of our chat. — 1 — Shut Your Trap: If there’s one topic Buyitt is passionate about, it’s this whole allowance thing. “They’re kids for Pete’s sake. Let ’em have fun. If they want something, just buy it for them.”

And money conversations? Don’t get it started. “What happens when your kid asks you how much you’re saving for retirement? That’s not a conversation I want to have with my child. Do you?”

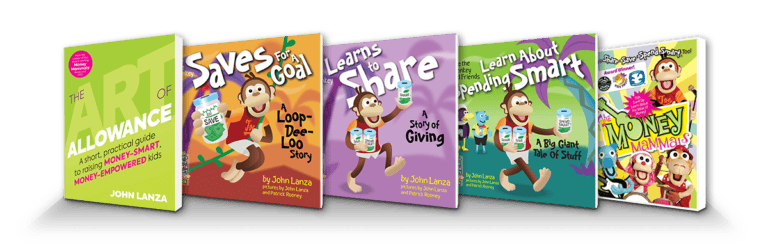

(BTW, I love how these new AI systems can envision themselves with progeny. So can they get married? 🤔) Anyhow, Buyitt also emphasizes its lack of faith in our kids. “They can’t be trusted with money,” it tells me. And Buyitt is confident kids will learn what they need to know about money smarts in school. Or on TikTok. Or from their friends. And if not, they’ll certainly figure it out on their own. When they head out into the cold, cruel world. Until then, Buyitt advises us parents to shut our traps and open our wallets. — 2 — Vargas’ Biggest Fan: As it turns out, Buyitt has a favorite Money Mammal. “Vargas the Vulture is kind of my hero. Honestly, I’m a bit of a fanboy. Too bad he’s always thwarted in his attempts to get Joe the Monkey to buy awesome stuff, like the Terrific Tiger Coconut Hero trading card and green vine licorice. A tragedy, really.”

And when I point out that Vargas the Vulture isn’t technically a mammal, Buyitt smiles. “Good for him!” Like Vargas, Buyitt believes that when you make more money, you’ve got to get more things. To it, earning and spending go hand in hand. In fact, Buyitt thinks the most important lesson our kids can learn is that when our incomes rise, our expenses rise too. “A rising tide lifts all wallets, right?” Buyitt goes on to explain that saving for goals or retirement is literally missing the forest for the trees. Especially when our Instagram feeds are full of the good stuff in life: hotels with infinity pools, wrinkle-free shirts and viral lobster rolls. — 3 — Weekly Wisdom: I am surprised to learn that Buyitt is well read. In fact, Oscar Wilde is its intellectual hero. “Anyone who lives within their means suffers from a lack of imagination.”

– Oscar Wilde

Buyitt is confident Wilde would have been an early adopter of BNPL (Buy Now Pay Later) technology. “It’s like it was invented for him. Too bad he’s dead.” “Why Wait” is Buyitt’s mantra, and I can tell you it is true to its word. For instance, it collects credit cards and racks up charges because that’s the point. Obviously. And when I show it this classic Saturday Night Live skit, Buyitt tells me it feels a special connection with Amy Poehler and Steve Martin. Well, that’s all, folks. I’m guessing (and hoping) you’ve figured out this week’s “3 Ideas to Share & Save” theme: April Fools! 🤪 I hope you enjoyed this journey into an alternate money universe. John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|