|

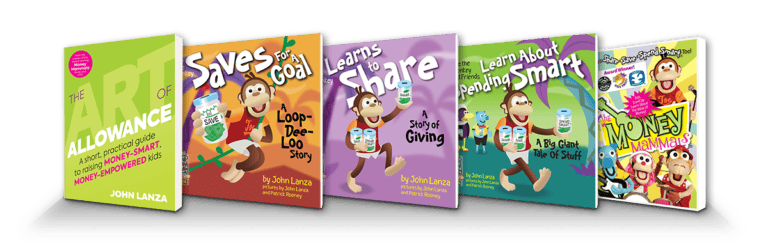

In this issue: Filling your money-smart rucksack, becoming a one percenter and considering perspectives on time. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! I’ve returned from dropping off my daughter at school, which means my wife and I are back to being empty nesters. But it also means I’m back to sharing this newsletter with you. So let’s dive into this new installment! — 1 — Fill Your Rucksack: Strategic thinking is deeper than tactical thinking. It takes a “big picture” mentality and requires that you ask yourself why you’re doing something. Sun Tzu, author of The Art of War, said proper strategic thinking requires a state of shih. And in his Daily Laws, Robert Greene describes Tzu’s shih concept as a “bowstring stretched taut.” The “arrow can go in any direction,” depending on the action of the enemy. There are no “preordained steps.” Instead, you are prepared and “giving yourself options.” This newsletter takes a similar approach. I share with you ideas (Let’s call them options.) to help you create a workable strategy to raise money-smart kids. So think of each edition as being full of navigational tools you can add to your rucksack as you journey toward money empowerment. But along the way, challenges abound. There will be rivers to ford, like figuring out whether tying allowance to chores is right for your family: Then there are ravines to traverse, like helping your kids learn investing requires something not many tweens and teens possess — patience: And there could even be beasts to evade, like the college loan you must avoid: This newsletter gives you options with which to fill your rucksack to put you in that state of shih, hopefully preparing you for any obstacle on your journey. (And if you’re looking for a wilderness guide, my book, The Art of Allowance, can help.)

— 2 — We Are All One Percenters: In his book Atomic Habits, James Clear illuminates an idea you may have encountered — the power of 1% (incremental) gains. In this short audio clip, Clear clarifies this concept using the surprising rise of British cycling as his example. Clear explains that Dave Brailsford was hired to change the team’s trajectory. He quickly employed the concept of “aggregation of marginal gains,” or, in less nerdy terms, “the 1% improvement in nearly everything we do that’s related to cycling.” British cycling made obvious improvements, like lightening tires, updating practice protocols and refining aerodynamics. But Brailsford went beyond the basics. He implemented more small changes, including hosting a surgeon to demonstrate proper hand-washing techniques to reduce sick days and having riders bring their favorite pillows on the road to ensure proper sleep. The team won its first Tour de France in three years, two years ahead of Brailsford’s schedule. Impressive! As Clear’s cycling story demonstrates, compounding is essential to not only investment growth but also personal growth. So it’s a tool you can utilize on your money-smart journey:

So small improvements make a big difference: “Because if you can build better habits, if you can make a small 1% improvement in your daily habits, you don’t just reap that habit once. You reap it day after day…it starts to compound. And this is sort of a hallmark of any compounding process. The greatest returns are delayed.”

—James Clear [lightly edited]

— 3 — Weekly Wisdom: Whether it’s at preschool, grade school or college, dropping off your youngest child can alter your perspective on time. At each milestone it’s hard for me not to think of the adage “The days are long, but the years are short.” Here are some more perspectives on time: “For an infinite player there is no such thing as an hour of time. There can be an hour of love, or a day of grieving, or a season of learning, or a period of labor.”

“Time is a river that sweeps me along, but I am the river; it is a tiger which destroys me, but I am the tiger; it is a fire which consumes me, but I am the fire.”

—Jorge Luis Borges, “A New Refutation of Time”

The Borges quote above reminds me of the idea I first read in Oliver Burkeman’s Four Thousand Weeks that we are time. So let’s take time today to enjoy the journey! John, P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

View this email in your browser. Forwarded this email? Sign up here.

|