“The Way in the world

Is as a stream to a valley,

A river to a sea.”

— Ursula K. Le Guin’s translation of The Tao by Lao Tzu

The Tao, a timeless source of wisdom written in ancient China, reminds us we must not lose the whole in the multiplicity of the parts.

Put another way: We don’t want to miss the forest for the trees.

We are on a journey to money empowerment with our kids. Every journey has its challenges, and we often wander on and off the path.

My daughter, for example, has been spending more money on shared rides recently. When I’m arguing with her about these trips, I can see only the trees on the ground. Each one looks like an expensive shared ride with surge pricing.

Yet if I float up above the trees, then I can see the forest. My daughter is working this summer and making good money to pay for not only these trips but also freshman year expenses. She is also saving for her first year of college in a special, high-interest account my wife set up. (Sorry, it’s available only to her.) And every month a small, automated deposit from her allowance continues to be transferred into her investment account.

The forest is nice and lush. As I float above it, I realize that I didn’t even have an investment account as a teenager. My daughter is further along her journey to money empowerment than I was at her age. Way further.

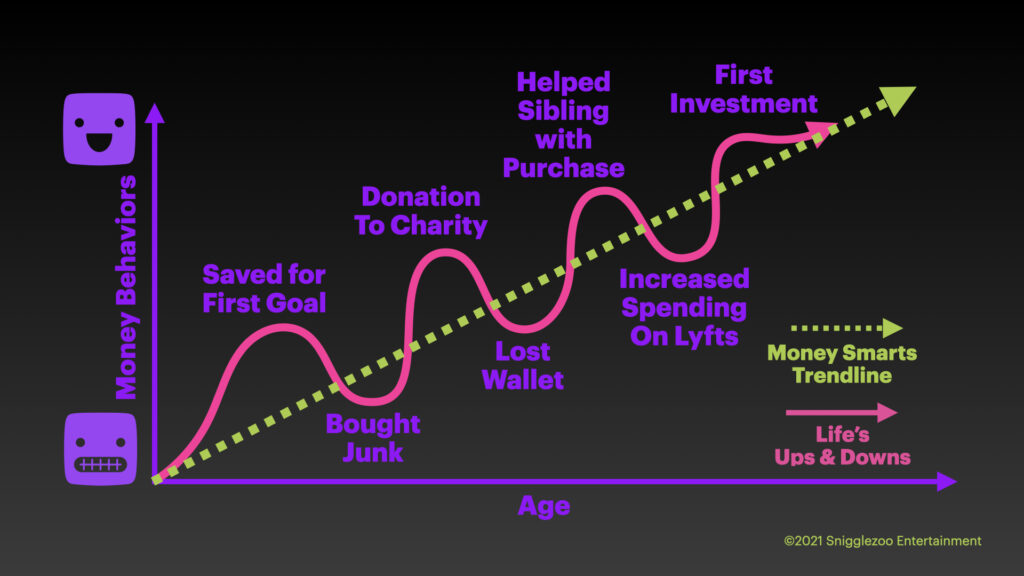

In my Art of Allowance Academy classes for parents, I share a graph like this one below.

The undulating waves represent the tree level: the specific constructive and destructive money behaviors encountered. This is life. Naturally, there are ups and downs. The straight line heading upward is the forest, or the overall trend. We want the direction of travel to be more or less one in which overall money-smart behaviors increase with age towards money empowerment.

I created this graph to help parents look beyond the questionable, day-to-day decisions that cause ongoing anxiety. If we can keep the big picture in mind, then we can see that our children are building the money smarts they’ll need to thrive in the real world.

Our kids are coming of age in the gig economy era, amidst a fraying social safety net and during the demise of traditional pensions and other employee benefits. They will need to be stewards of their own financial lives in a way that previous generations did not. In short, they live in The Age of Self-Sufficiency.

Here’s a helpful “10,000-foot view” above the forest that I created for parents in our new Art of Allowance Project program. This interactive chart can help us see what we can be teaching our kids, and when.

Being a parent is difficult. We see a child do something nasty to a sibling, and we think, “Are we raising a monster?”

Our academically consistent child gets one lousy grade, and we think, “Is this the beginning of a trend?”

I sometimes think, “What happened to my thoughtful, money-smart child?” Then I remember that it’s her last summer before college and that she just endured over a year inside with her parents during a pandemic.

It’s not always easy, but I need to rise above it all and see the forest instead of the trees.

John

I want to thank Erin Prim and fellow Foster writers Jillian Anthony, Daniel Sisson, Alberto Sadde and Sara Campbell for their help bringing clarity to this essay.

Featured image by Olena Sergienko on Unsplash