Hi there, credit union friends,

If you’re regular readers of this newsletter, then you might recall that I covered Snigglezoo’s Credit Union Youth Month celebrations in the most recent issue. But for anyone new to “Marketing Manatee Musings,” or for those of you in need of a refresher, our team:

- Participated in a live Q&A hosted by the financial wellness platform Pocketnest

- Offered an Art of Allowance Academy interactive course to the employees and members of Patelco Credit Union

- Collaborated with Growth by Design, a subsidiary of the League of Southeastern Credit Unions, on a webinar for its “Learning with LEVERAGE” series

So for this edition, I thought I’d turn the tables to highlight what our credit union partners were up to during Money-Smart Month. Read on to discover several stellar strategies these institutions utilized to engage kids and empower parents in April!

— 1 —

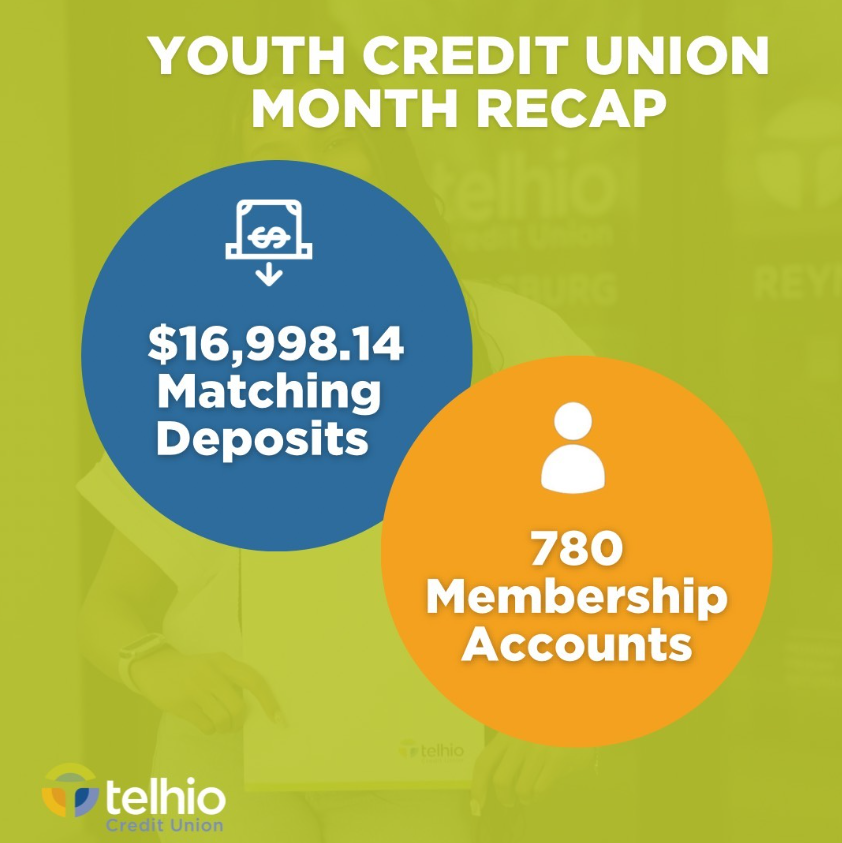

A Perfect Match: Ohio-based Telhio Credit Union chose to spotlight the importance of saving during this year’s Credit Union Youth Month. Specifically, they matched any deposits (up to $25) their young members under age 18 made into share accounts throughout April.

As can be seen in the following graphic, the totals for this initiative were impressive:

For you number crunchers out there, that’s an average of almost $22 per member! 🤯

Matching at this magnitude not only drives deposits but also promotes good money habits. (For more on this topic, stream the video series for tweens and teens featured on Telhio’s Adolescent$ portal.) And Telhio recognizes this connection, for the credit union noted when sharing the month’s stats on their social channels, “We are committed to helping our members build valuable money skills and habits to serve them well throughout their lives.”

— 2 —

Hooray for Vacay: One of our newest Art of Allowance Project partners, Maine Family Federal Credit Union, punctuated their Money-Smart Month festivities with a week-long celebration. They leveraged the Spring Break school holiday to drive branch traffic with themed activities, including:

- Build your own birdhouse

- Design your own bookmark

- Money Mammals story time

- Design your own Save jar

- Ice cream and games

And the financial fun wasn’t limited to the credit union’s young members! Branch staff joined in as well to set the sharing, saving and spending smart stage. Check out this impressive Joe the Monkey sign freehanded by Maine Family Consumer Lending Manager Hannah Lelansky:

During the same April Vacation Celebration Week, Maine Family got new young members off to money-smart starts by depositing $25 into their savings accounts. (I sense a pattern, don’t you? 😉) The credit union also sponsored a coloring contest featuring The Money Mammals program’s April printable. Five lucky winners each received a gift card to a family-owned ice cream shop, demonstrating to young Maine Family members the importance of spending smart by shopping locally and investing in their communities.

— 3 —

It Takes Two: For Illinois-based Great Lakes Credit Union, April marked not only Credit Union Youth Month but also the soft opening of their 14th branch. The credit union has partnered with The Leaders Network, a self-described “group of dedicated community and faith leaders,” to open a permanent location in what has long been considered a financial desert, the Austin neighborhood of Chicago’s West Side.

Great Lakes marked the occasion by collaborating with our design team to produce co-branded Money Mammals printables and newsletters for their newest young members. Here’s a peek at both pieces:

We applaud Great Lakes for their commitment to serving the unbanked and underbanked and look forward to continuing the celebrations during this month’s grand opening! 🥳

📸: GIPHY Studios 2021

Well, friends, I hope you’ve enjoyed learning about the goings-on at a sampling of our partner credit unions during Money-Smart Month. Even though these initiatives were in place for a particular period, they could be tweaked for deployment year-round. And if you have other ideas for connecting with kids and families as we head into the summer months, then please share! I’m sure your fellow credit union colleagues will be much obliged, and this Marketing Manatee would love to shine a spotlight on your efforts.

Until next time, here’s to putting our best fin lit flippers forward!

Erin Prim

Marketing Manatee