“Working to help parents raise money-smart kids.”

Hello, friends!

Some weeks, this newsletter comes together quite easily. Other weeks, not so much. Unfortunately, this week fell into the second category. But after much trial-ing (I like making up words. 😉), I think I finally have 3 ideas worth sharing with you.

— 1 —

Granddad Knows Best: My grandfather’s advice to me when I graduated college was simple: Live beneath your means, and understand the power of compound interest. It only took me another 20 years to truly comprehend the power of his words. So now I write this newsletter to help us all help our kids internalize such essential life lessons earlier than I did.

Despite its effectiveness, the problem with compound interest is that it’s unlikely to make an impression until you begin to experience it, however nicely you illustrate it. (And we created a great graph, if I do say so myself! 👇)

As my wife and I were looking through our investments recently, it was gratifying to see our retirement numbers growing. So I mentioned a stat I heard Morgan Housel tell Tim Ferriss in their recent conversation: Warren Buffett attained 99% of his wealth after he was 50 years old. And 97% of it after he was 65.

WOW.

My wife and I are, of course, orders of magnitude behind Buffett, but we still have time on our side. Intellectually, we both know the power of compounding. Still, it’s difficult for us to truly comprehend the effect that time will have.

I tell you this because, yes, you should show the beautiful chart above to your children. (If for no other reason, then to say, “I told you so.” 🤣) And to better understand the concept, your school-age kids can even play with Clara’s Compounding Calculator on our partner Service Credit Union’s site.

However, don’t expect the lesson to stick yet. The real impact, just as with the effect of the ongoing money conversations we have with our children, will compound over time.

Of course, there is something we can help our kids start today …

— 2 —

Delicious, Not Nutritious: To this day, I can still sing the advertising jingle for Lucky Charms. 🎶 “Frosted Lucky Charms! They’re magically delicious!” 🎶

And just like Sonny, I was “cuckoo for Cocoa Puffs”! Even now, this bird still holds some of my mindshare as I walk down the cereal aisle.

Also, who didn’t try Life because even “Mikey liked it”?

Admittedly, these were some wonderfully creative ads. The problem, however, is that they all peddled junk, even though each cereal promoted itself as “nutritious.” Wait a second while I finish off this diet donut. 🙄

Ads like these work because kids not only recognize brands before they head to kindergarten but also perceive how specific ones might help them get ahead. What’s more, the American Academy of Pediatrics tells us that children can’t distinguish between advertising fact and fiction until they’re around 8 years old.

Despite my favorite cereal ads’ predating this research, the creative marketers responsible certainly intuited the connection. It’s no surprise to any parent that kids can be captured by brands at a very young age.

What’s actually a surprise is that we’re not all taking steps right now to talk with our children about advertising more often.

— 3 —

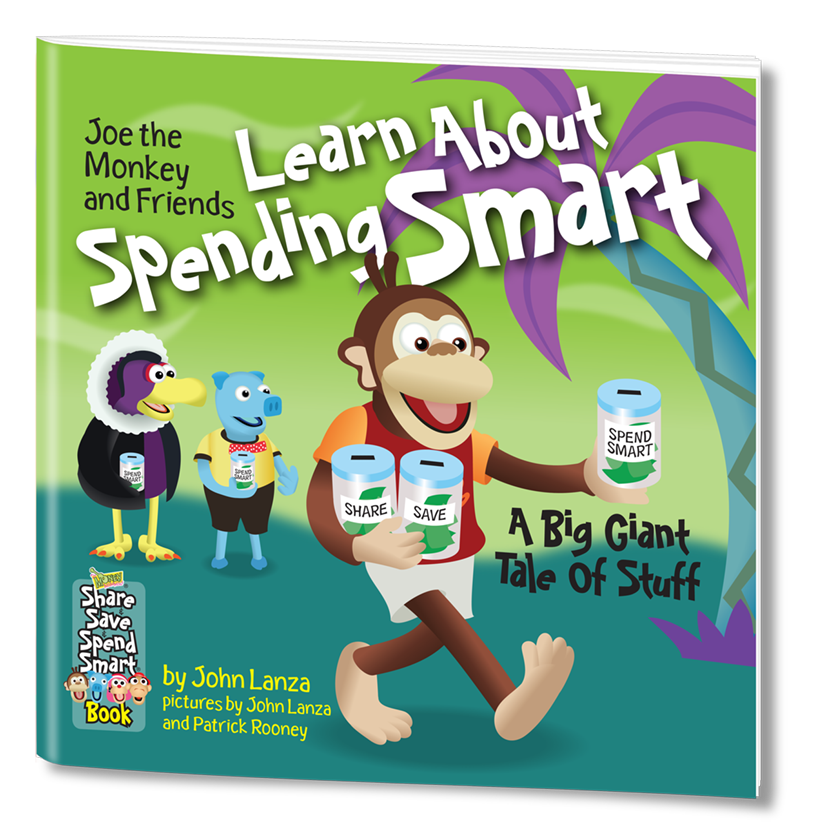

Reading Guide to the Rescue: If you’d like to start a conversation with your kids about becoming media-savvy, then you might enjoy the third book in my “Share and Save and Spend Smart” series, Joe the Monkey and Friends Learn About Spending Smart.

It it Joe’s friends seem to lose their minds over the popular new collectible, Stuff, and Joe can’t figure out why. If your child is a Money Mammal at any of our partner credit unions, like GECU in El Paso, then you can read a digital copy on your mobile device. And if your credit union isn’t yet a partner, then ask them to connect with us to join our movement.

But wait! There’s more! (Cue the infomercial graphics! 😂) We created a reading guide that accompanies the book and offers some fun activities for your aspiring media critic, including analyzing ads for various marketing tricks (some of which I wrote about in this essay).

As always, thanks for taking the time each week to help your kids get a little money-smarter. (There I go again with the made-up words! 🤦♂️) Until next week, please remember to enjoy the journey!

John, Chief Mammal

P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being.

Like what you just read? You can sign up for the newsletter here.