|

In this issue: Highlights from my latest podcast episode, an invitation to join my money-smart course and sage advice from my grandfather. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! We’re already a week into Financial Literacy Month. So we’re shifting into high gear with a new podcast episode, an updated course offering and some weekly wisdom for you. I hope you find these “3 Ideas to Share & Save” useful. — 1 — Colin Ryan Speaks: My friend and co-conspirator in the money-smart movement, Colin Ryan, joins me for a conversation about his comedic approach to personal finance.

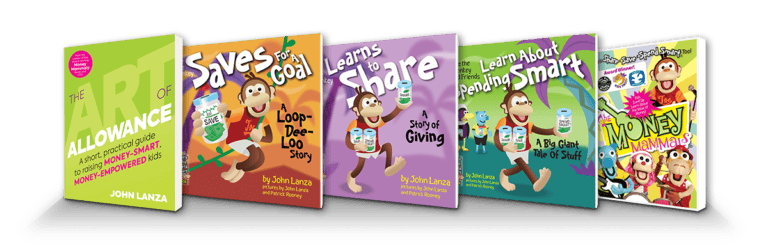

Colin has presented to over one million college students. (Yep, you read that massive number right! 🤯) We cover a lot of ground during our chat, including the “earning by saving” concept he wrote about in his book, A Comedic Guide to Money. We also tackle the role of parental money modeling and technology’s impact on financial well-being. And we further discuss personal finance’s emotional and psychological facets, finding success and contentment in a consumer-driven society, social media’s power, vulnerability’s importance and the value of connecting with your children through shared experiences. As a heads up, this episode lasts a little longer than normal because Colin and I dig deep into ideas that I think can help you have better money conversations with your older kids. — 2 — “Raising Money-Wise Teens”: There’s still time to register for my newest Art of Allowance Academy interactive course, “Financial Foundations: Raising Money-Wise Teens.” This event is sponsored by Patelco Credit Union and hosted by podcast guest Veronica Dangerfield. Here’s a description of what we’ll be covering this Wednesday: Whether you’re naturally thrifty or prone to spending, you can guide your child on a money-smart journey. In this webinar, we’ll review core financial skills that every kid should know, show you how to create an allowance system that grows with your child and share practical strategies to help set up your kids for success through every stage of life.

During our time together, I’ll also be highlighting some new ideas that I think will be particularly helpful for parents with older kids, including the Flex Allowance, the “circle back” technique (Okay, I already shared this one with you. 🫢) as well as how and when to end an allowance. — 3 — Weekly Wisdom: “Education is compliance-based, top-down authority, certificate-granting. It is checking the boxes and proving that you have this thing that used to be scarce is yours now. Learning is all autodidactic. Learning is, did you change by doing a thing?”

Financial Literacy Month can be overwhelming; the myriad of topics to cover can paralyze any parent. (The paradox of choice! 😳) I like to ask myself, “What are the key skills my kids need to learn?” (These are the ones without which money empowerment cannot happen.) And when doing so, I almost always return to my grandfather’s advice: Live beneath your means, and put the power of time to work for you. Our kids will learn these lessons, as Seth says, by doing these things. For instance, my wife introduced our daughters to thrift shopping, one step on the money-smart journey to living beneath their means. And podcast guest Bill Dwight‘s recent Roth IRA post can help you help your kids harness the power of time by putting that financial force to work for them. As always, enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|