“The gating factor for most people’s dreams, they think is money. But it very rarely is.”

— Kevin Kelly

Looking for some fresh perspective on your family’s money-smart journey?

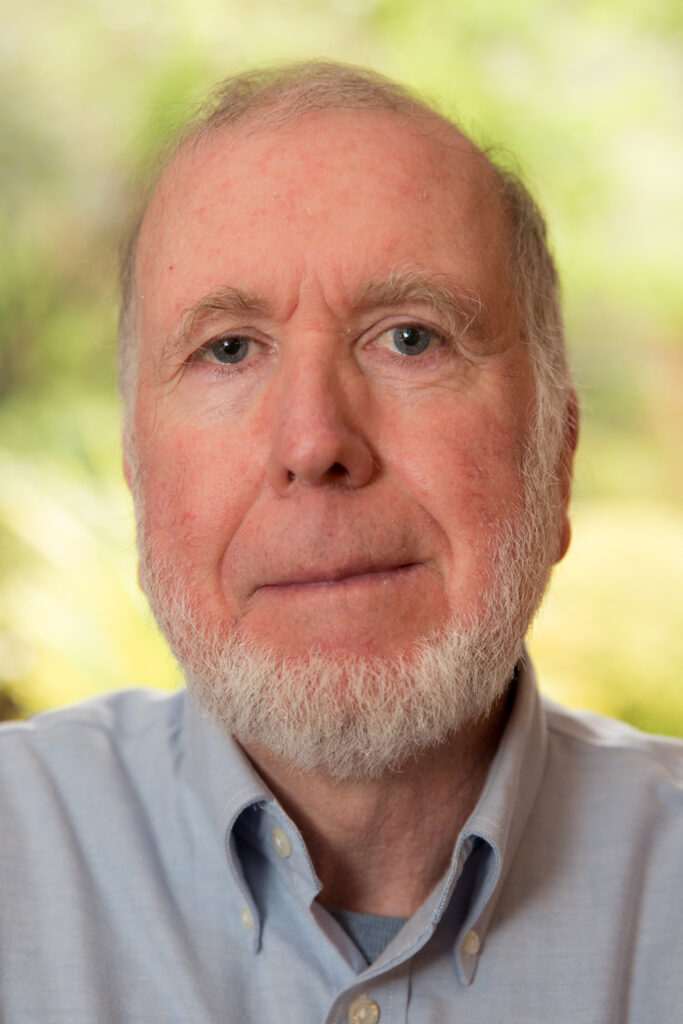

Kevin Kelly’s approaches to finances are sure to be conversation starters. Kevin is the Senior Maverick at Wired, an award-winning magazine he co-founded in 1993. He is also the co-chair of The Long Now Foundation, a membership organization that champions long-term thinking, and the founder of the popular Cool Tools website, which has been reviewing tools daily for 20 years. What’s more, Kevin has authored multiple best-selling books about the future of technology. His newest one, Excellent Advice for Living, contains 450 modern proverbs for a pretty good life.

Kevin is someone whom podcaster and author Tim Ferriss has described as the real-life “most interesting man in the world.” I love his writing and the radical optimism for which he is well known. (If you can’t tell, he is one of my intellectual heroes.) I hope you enjoy our wide-ranging discussion, which touches on topics from billionaires and dying broke to protopias and traveling Asia.

Links (From the Show)

- Connecting with Kevin

- Kevin’s website

- Kevin’s latest book, Excellent Advice for Living

- Kevin’s three-volume series, Vanishing Asia

- The WIRED magazine

- The Long Now Foundation

- The Cool Tools website

- The “Recomendo” newsletter

- Money-Smart Mentions

- Ursula Le Guin’s “The Ones Who Walk Away from Omelas“

- Michael Goldhaber’s WIRED article about a world without money

- The Wall Street Warriors docuseries

- Kevin’s appearance on the How I Write Podcast with David Perell

- Stephen Pollan and Mark Levine’s Die Broke

- Bill Perkins’ Die with Zero

- Morgan Housel’s The Psychology of Money

- Morgan Housel’s appearance on the How I Write Podcast with David Perell

- Michael Phillips’ The Seven Laws of Money

- Stewart Brand’s Whole Earth Catalog

- Richard Nelson Bolles’ What Color Is Your Parachute?

Show Notes (Find what’s most interesting to you!)

- Kevin as a “packager of ideas” [2:16]

- What is a “protopia”? And why is it better than its boring “utopia” counterpart? [4:57]

- Money’s losing importance as a meaningful metric [8:46]

- What Kevin has learned about money from being around billionaires [10:27]

- Kevin’s billion-dollar exercise [12:47]

- How much money do you need to realize your dreams? [13:31]

- How can looking into the past help kids save for the future? [14:37]

- Money as a familial versus an individual resource [20:50]

- Kevin makes the case for dying broke. [23:49]

- Why you shouldn’t try to be a billionaire [26:41]

- Money as gasoline [29:29]

- Kevin’s kids didn’t need access to a lot of money growing up. [32:55]

- A choice between private school and a new car [34:23]

- Kevin discusses working while in school. [35:08]

- “The most selfish thing you can do is to be generous.” [37:29]

- Kevin’s one-share approach to investing [41:55]

- Kevin’s monetary influences [43:08]

- The economic value of friendship [43:49]

- Money empowerment as access [45:37]

- Lessons learned by travel [45:53]

- “Money is a by-product of the good life.” [48:23]

- Being the only instead of the best [49:48]

- Another book recommendation [50:25]

- Kevin on the web [51:41]

If you liked this episode …

Need more advice about promoting patience to your children as they learn about investing and saving? Writer and speaker Will Rainey offers strategies to help kids harness the power of patience on their money-smart journeys. Tune in to his episode of The Art of Allowance Podcast at 8:10 and 45:26 for some tactics. You can also stream this short about the benefits of long-term returns.

Geeking out about the possibilty of reimagining money? Then jump into the metaverse with tech guru and credit union innovator Brett Wooden! During his podcast appearance, he discusses the promise and peril of the metaverse and how it can redefine finance as we know it. Listen in at 3:39 for an introduction to this “brave new world,” and watch this short on how the metaverse can impact financial education.

Want to explore alternative ways to grow your kids’ wealth? Digital marketing expert James Robert Lay offers advice on how to do so through his concept of “non-monetary deposits.” Start streaming his Art of Allowance Podcast episode at 33:04 or view this short to learn more.

Please Subscribe

If you like this podcast, then please give us a review and subscribe to the show. The Art of Allowance Podcast is available on iTunes, Spotify, Stitcher, Radio Public and now Amazon Music. Subscribing is free, and it will help me produce more enriching content for you to enjoy. Thanks!

You might also want to check out The Art of Allowance Project, our reimagined program to get your children excited about money smarts at any age. Until next time, I wish you and your family well as you journey forth.

Thanks for listening!

John