|

In this issue: Kids turning the money-smart tables on parents, the 2X allowance system and a nugget of weekly wisdom. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! We’re back to our standard Monday release after last week’s hiccup. 🤦🏻♂️ Thanks for your patience. And now, I present to you the act you’ve known for all these years…”3 Ideas to Share & Save”! — 1 — When Teacher Becomes Student: My conversation with Joe Saul-Sehy of Stacking Benjamins fame dropped last week. In it, Joe shares this wonderful anecdote about his daughter, Autumn, lecturing him about a household money-saving technique. I recount a similar story about my daughter in this post about “needlets”: My iPhone shattered. “I knew I should have bought that OtterBox,” I said, turning to my daughter, who’d seen me drop it. “I need to buy a new iPhone.”

She paused, smiled and replied, “You don’t need to buy a new iPhone.”

I smiled back. Touché! So she’d been listening to what I’d been saying about needs and wants all along.

It’s rewarding when our kids internalize important lessons even if, or perhaps especially when, they turn the tables on us and become the models or masters. — 2 — The 2X Allowance: While most allowances follow the ODAWPA model, Joe Saul-Sehy took a page from David Owen, a fellow podcast guest and the author of The First National Bank of Dad, to ensure his kids were just flush enough with cash to optimize for early money mistakes. This strategy borrows from the wisdom of previous podcast guest and researcher Ashley LeBaron-Black, who emphasizes the importance of leveraging low-stakes mistakes: “It’s important for parents to give kids age-appropriate financial experiences when they’re monitoring them. Let them make mistakes so you can help them learn from them, and help them develop habits before they’re on their own, when the consequences are a lot bigger and they’re dealing with larger amounts of money.”

Joe Saul-Sehy and David Owen optimized for mistakes. This was the why behind their approaches. It’s important to know your why and to optimize for what matters to you and your family. — 3 — Weekly Wisdom: “Hollowed out, clay makes a pot. Where the pot’s not is where it’s useful.”

—Lao Tzu, Tao Te Ching

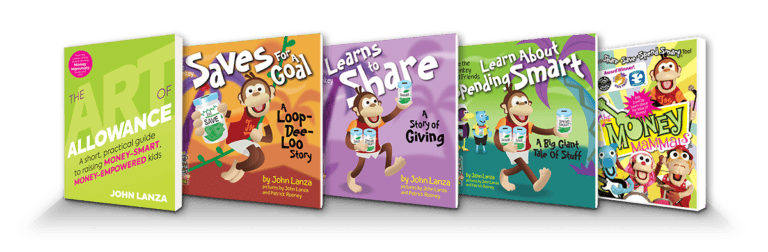

I think of The Art of Allowance resources I share with you—my book, the podcast and this weekly newsletter—as clay from which to mold our allowance systems. You choose whether to try the ODAWPA method or Joe Saul-Sehy’s 2X technique. You decide whether to tie your allowance to chores. And as your kids get older, you may require your teens to work. Or you may take David Owen’s approach and consider school their work. These ideas and frameworks are the clay you use to shape your art of allowance. Where the system is useful is where the pot is not. It’s in the hollows, in the experiences our kids have with money. Whatever shape our pots take, let’s be sure to enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|