“Working to help parents raise money-smart kids.”

Hello, friends!

Over eight years ago, my wife, Eileen, suggested I read The Miracle Morning by Hal Elrod.

I consider it one of the most impactful books I’ve ever read because it kick-started several transformational daily practices of mine, including:

- 10 minutes of meditation

- Exercise

- 30 minutes of reading

Although I may elaborate on the first two habits in a later newsletter, I’d like to focus on the reading component this week.

Reading half an hour every day helped me increase my book consumption from about two titles a year to over twenty works a year. If you’re curious about my selections, then connect with me on Goodreads.

I’m able to carve out this time by waking up at 5:00 am most days. “How?” you ask. In The Miracle Morning, Elrod proposes a simple strategy: Put your alarm clock across the room to move the snooze button out of hand-slap range.

This tactic worked for me, as I discovered that the physical act of getting up to turn off the alarm was enough to kick-start my morning.

I then took Tiago Forte’s Building a Second Brain online course, in which I learned how to progressively summarize books. Doing so helps me convert my highlighted notes into action items that I can use to create, for example, this newsletter.

So for this edition of “3 Ideas to Share & Save,” I’m revisiting my notes on Ron Lieber’s excellent book, The Opposite of Spoiled, to give you some practical ideas and food for thought to help you on your money-smart journeys.

— 1 —

“Joy in a Job Well Done”: Per my progressive summarization technique, below is a passage I highlighted on Kindle, pasted into Evernote and reviewed years later.

In the short selection, Lieber grapples with the connection between allowance and chores.

If you’re a regular reader, then this topic is a familiar one. Parents always seem in search of novel strategies to address it, so Lieber cites one family’s interesting approach to the dilemma:

“They want him to know that there can be joy in a job well done. So while Liam earns no money for basic chores, he does get paid for recognizing problems and solving them. When he spotted all the fallen leaves in the backyard, he offered to rake them and negotiated a price. His grandparents’ dirty car inspired him to wash it to make some money.”

(You can see above how progressive summarization helps me bring this concept to you. In my first pass of book notes, I bold text that continues to resonate with me. In my second pass, I underline key words or phrases. So when I return to my notes, it’s easy to find meaningful messages to share.)

This tactic is unique because it taps into our kids’ intrinsic motivations rather than imposes our will on them.

Even though I like this approach, I often have mixed feelings when I share such creative ideas. On the one hand, I’m excited you might find them useful. And on the other, I wish I’d been able to incorporate them in our family’s allowance system when my kids were younger. 🤷🏻♂️

Creating systems that work for individual families is an art, hence The Art of Allowance. But we can learn from each other’s successes and failures as we work to craft flexible programs to raise money-smart kids.

And as an added bonus, here’s a recent Instagram video about allowance and chores that you might find useful as well.

— 2 —

Media Smarts: I’ve written a lot about sharing, saving and spending smart. Becoming money-empowered, though, includes acquiring media smarts as well.

To that end, here’s a short essay I wrote in which I liken the marketing landscape to gladiatorial combat. Since our kids frequently find themselves in the arena, we must arm them with appropriate tools for defense.

In The Opposite of Spoiled, Lieber includes this wonderful example of how a mom gamified the media-smart learning process:

“She doesn’t set the DVR to avoid commercials on her television. Instead, she turns the reading of commercial messages into a game with her daughter. ‘We have a race to see who can say first what subliminal messages they’re trying to send us,’ she said.”

MW: game idea — spot the tricks

You might be wondering about that last phrase, “game idea — spot the tricks.” When I progressively summarize a book, I often include my own thoughts. The abbreviation “MW,” short for “My Words,” sets my musings apart from those of the author. And in case you’re wondering, we haven’t created the game I mention just yet. Hopefully soon! But we do have other helpful resources you might like. You’ll find more info. on them below. 👇

For now, let’s get back to the theme of this second idea, media smarts. Lieber also highlights a study that underscores the power of marketing to influence our kids’ choices about not only toys but also friends:

“Given the choice between playing with a nice boy who didn’t have any Ruckus Rangers and a not-so-nice boy who did, just 35 percent of the kids who had seen the commercial chose to hang out with the nice boy with no toy. When researchers asked the same question the next day, it had gone up but only to 49 percent. The commercials actually seem to have caused the kids to value getting their hands on the toy over the virtues of their playmate.”

So, yes, our efforts to raise media-smart kids matter.

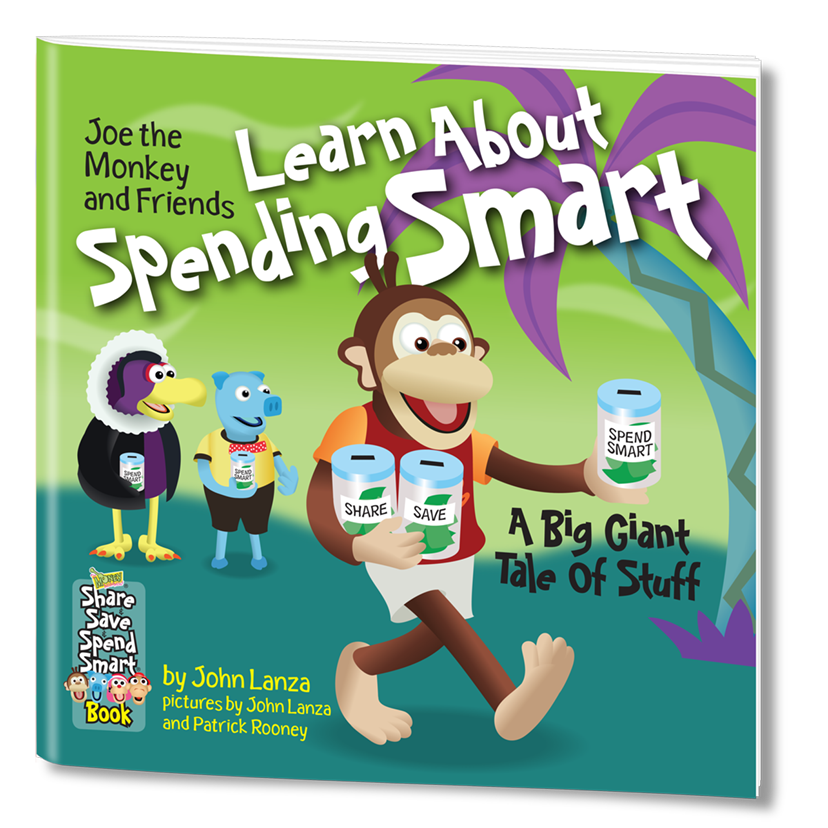

Therefore, I wrote my third children’s book, Joe the Monkey and Friends Learn About Spending Smart, to introduce kids to the importance of becoming media-smart.

Joe the Monkey and Friends Learn About Spending Smart is available as a complimentary e-book if you are a member of one of our many credit union partners, like Georgia United Credit Union and Service Credit Union. It is also featured in our Complete Money Empowerment Kit.

The book is paired with a reading guide that you can use to teach kids about techniques designed to trick them into buying things they may not want or cannot afford. Download it here to give your kids several tools to use in the marketing arena.

— 3 —

It’s a Journey: If you’re a consistent reader here, then you know that I refer to becoming money-smart as a journey we take with our kids.

Lieber talks about how we can evolve as we move through this process:

“One of the most profound challenges of having kids is that raising them isn’t simply about shaping their financial values and decision-making skills. Teaching them means questioning our own priorities as well, which is a healthy thing to do in any event.”

My experience on my family’s own money-smart journey has certainly made me think a lot about what money means to me and how I can best help my kids learn to use it as a tool.

And speaking of using money, the ways we do so can help impart values. For example, the purpose of the Share jar is to set aside money for charitable opportunities. That way, our kids aren’t deciding between spending reserved money on themselves or donating it to a worthy cause.

I talk more about how an allowance can teach values in my conversation with financial psychologist Brad Klontz:

I hope you enjoyed this week’s edition of “3 Ideas to Share & Save.” If you did, then please share it with one person who you think would benefit.

And as always, enjoy the journey!

John, Chief Mammal

P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being.

Like what you just read? You can sign up for the newsletter here.