|

In this issue: Simplifying stocks for our kids, determining when to end an allowance and digesting a nugget of weekly wisdom. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! Before we dive into this week’s ideas, here’s a quick reminder: You still have time to sign up your child for Moolah U‘s entrepreneur camps run by podcast guest Gayle Reaume. Check out Idea #2 in this newsletter for more info and a registration discount. And now, we’re going to keep things simple. Literally. — 1 — Simplify Stocks: Investing can be complicated. Even intimidating. How do you navigate price-to-earnings ratios, dividend yields and company 10k reports? 🤯 Evan Wilson, my latest podcast guest, tells us to keep it simple when it comes to kids and stocks: Just as we wouldn’t crack open a James Joyce novel as our children are learning to read or discuss differential equations alongside multiplication tables, we can pump the brakes when introducing investing. Think about all the knowledge Evan, who invests for a living, could share with his kids. But the problem with firehosing information at our children is that it waters down the magic of learning. We humans learn best when we are challenged just enough to be engaged and find ourselves slightly out of our comfort zones. Not when we become overwhelmed to the point that we throw in the towel. Keep. It. Simple.

— 2 — Allowance’s End: The Stacking Benjamins Show‘s creator and host, Joe Saul-Sehy, actively conversed with his kids about money. (They’re now adults and “mostly money-smart,” as podcast guest Robin Taub might say.) And he used an allowance as a tool to teach them good money habits. So he gave an interesting answer to an oft-asked question: “When do we stop a kid’s allowance?” Joe’s not the only money maven whose allowance journey with his kids ended naturally. David Owen, the author of one of my favorite books about raising money-smart kids, The First National Bank of Dad, shared a similar story about his children. If you haven’t listened to our full podcast conversation, I highly recommend loading it up right now because David is a font of money-smart tips and tactics.

— 3 — Weekly Wisdom: “I never get bored with the basics.”

—Kobe Bryant

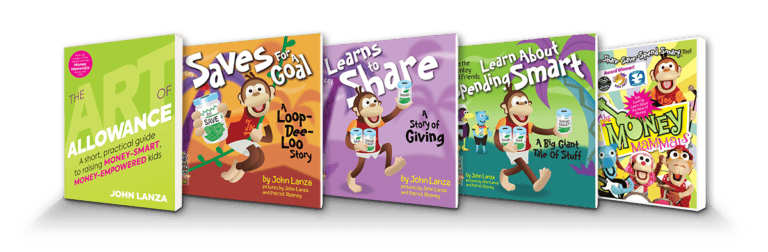

We celebrate great performers, like the late Kobe Bryant, for what they achieve in public. But it’s the habits they practice in private that generate those outcomes. The Money Mammals, the characters who have been on this journey with me from the beginning, sing about core skills to instill money smarts in children from a young age: We want our kids to develop the good habits (sharing, saving and spending smart) that generate the positive outcomes (money empowerment). Getting to the gym when everyone else is sound asleep to work on the same shots you’ve been taking for years is hard. And so is saving a consistent percentage of your money in a world awash in conspicuous consumption. Consistency pays off. It always does. And while you’re keeping it simple, don’t forget to enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being.

View this email in your browser. Forwarded this email? Sign up here.

|