We live in The Age of Self-Sufficiency.

Our great-great-grandfathers likely had one job their whole lives. I’ve had four adult jobs. My kids might have twelve to fifteen in their lifetimes. Gone are the gold watches for fifty years of service. And so are the pensions.

That’s a substantial change in very little time.

And change is everywhere. I was part of the first generation to which credit card companies actively marketed. My parents didn’t know they had to teach their children to be money-smart. There was a sense that the gold watch and a pension — financial security — would be waiting. They didn’t know that amassing credit card debt would become a rite of passage.

With passive financial security going or gone, coupled with the unethical behavior of some financial institutions, we parents must act.

Kids have always been better off with money smarts. But now, they need money smarts to survive, let alone thrive. If you want your children to live rich, happy lives, then you need to teach them how to take control of their money.

Do you use cash the way you used to? Of course you don’t. COVID has accelerated digital payments, and Venmo-ing friends is so convenient.

So rather than show your kids how to balance a checkbook (Remember, they can see their finances in real time now!), make sure they’re doing a weekly or monthly review of their digital expenses.

Software as a service (which I also wrote about here) is convenient, but it can behave like a leaky faucet — those drips can cost you a bundle.

Start an allowance early to teach your children the core money-smart skills so that they can eventually level up as they become teens.

“For the very first time, our happiness is in our hands.”

— Daniel Gilbert, Stumbling on Happiness

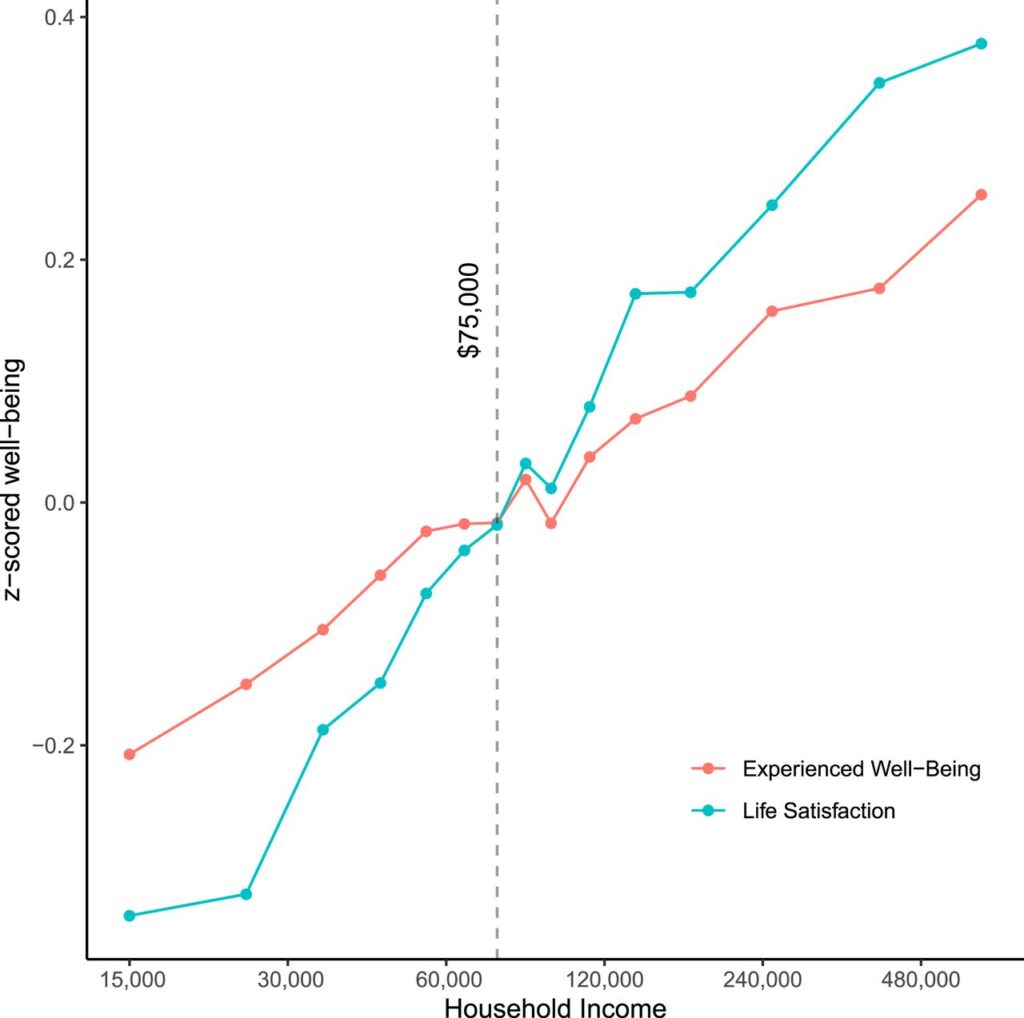

Surprising new research upends the decades-old idea that moment-to-moment happiness, or experienced well-being, flatlines around $75k. It grows with income.

How is it that in a country obsessed with money, so many of us fail to openly discuss the essential topics our kids need to learn to become money-smart?

We read to our children from a very young age. We should talk to them about money too.

We can help them become comfortable with the language of money early so that they eventually learn how to use it as a tool that they control — investing it, saving it, sharing it and spending it wisely.

When we raise our kids to be money-smart, they can thrive in The Age of Self-Sufficiency.

John

Big thanks to Stew Fortier, Erin Prim, Alberto Sadde, Ergest Xheblati, Soma Mandel, Katherine Canniff and Foster.

Featured Photo 37278426 © David Burke | Dreamstime.com