Money-Smart Mondaywith John Lanza Hello, friends, Welcome to Money-Smart Monday! I’m back after evaluating how this newsletter can be more useful for you to read and more enriching for me to write. I will, of course, continue to share ideas about raising money-smart kids. However, this new format gives me more freedom to share broader themes about money, happiness, time, fulfillment and more that I gather from the internet, podcasts, books and, as you’ll see below, a personal experiment or two. I hope you enjoy the new Money-Smart Monday! Podcast guests I collaborated withArt of Allowance Podcast alum Cameron Huddleston tapped me to contribute to her new post, “How Much Should You Tell Your Kids About Your Finances?“ Cameron is a pro, and her piece recently ranked third on Google for “talking to your kids about your finances.” I provided ideas to help parents of young kids, like starting money conversations early to prime the pump for more detailed discussions when they’re older. Andy Hill — another pod guest — had this to say about his kids, now in their tweens and teens: “‘They are now aware of how much we make, the fact that we choose to live debt free and our general net worth. […] Through this openness, our kids ask additional questions that help them learn how to create a strong financial foundation for themselves.'”

My wife and I weren’t radical sharers like Andy. But it’s true that once your kids are applying to college and filling out the FAFSA, they’ll get to see what’s behind the curtain. And Cameron wrote: “As your children become young adults, consider sharing details of your retirement planning, estate planning and long-term care planning—especially if you’re counting on them to play any sort of role in your financial life as you age.”

Experiment I learned from

|

|

📗 Get The Art of Allowance (for parents)

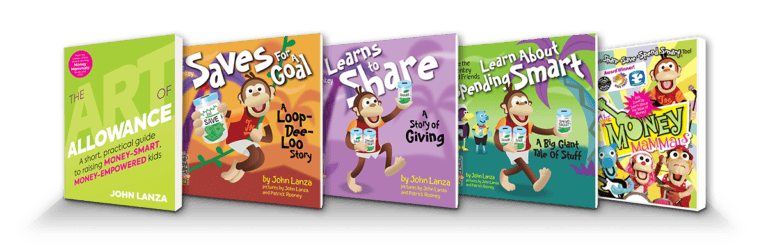

📚 Get the “Share & Save & Spend Smart” series (for kids)

🫱🏻🫲🏽 Become a partner (for businesses)

P.S. Please consult with a financial or investment professional before making any decisions that might affect your financial well-being.

Forwarded this email? Sign up here.