|

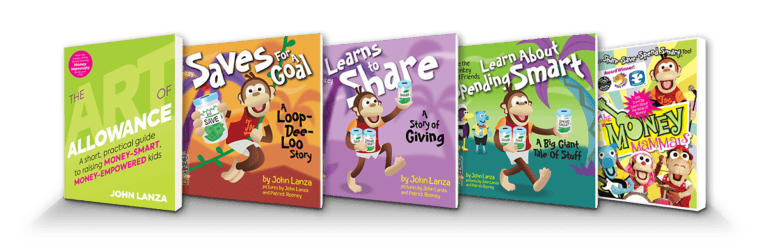

In this issue: Not letting your allowance rules imprison you, discovering short and sweet money-smart munchies and digesting another nugget of useful wisdom. “Working to help parents raise money-smart kids.” 3 Ideas to Share & Save Hello, friends! This week’s “3 Ideas to Share & Save” include: 1️⃣ Not letting your allowance rules imprison you 2️⃣ Discovering short and sweet money-smart munchies 3️⃣ Digesting another nugget of useful wisdom Now on with the show! — 1 — Simple Rules, Loosely Held: At The Art of Allowance Project, we adhere to simple rules. A core tenet of our allowance system is to turn over purchasing control to our kids, as they tend to be more responsible spending their money rather than our funds. We move from the starter ODAWPA (One-Dollar-Per-Week-Per-the-Age-of-the-Child) Allowance to one that gives our older kids more responsibility. Although I call this upgrade the Breakthrough Allowance in my book, I now refer to it as the Flex Allowance to account for the diverse ideas I’ve discovered in talking with money experts and parents (And often both!) on the podcast. Speaking of the Flex Allowance, I was coaching a mom who increased her daughter’s allowance and made her responsible for food out with friends. A few weeks later, she called me to ask if it was okay to buy her daughter an ice cream when they were out and about. Of course, it’s fine to indulge our kids from time to time. That’s one of the fun parts of being a parent! This situation is a good reminder that our allowance should have simple rules that we hold loosely. We can adjust on the fly and not let our systems imprison us. — 2 — YouTube Shorts (And Sweets!): If you haven’t visited our YouTube channel lately, then you’re missing out. For those of you kicking off your money-smart journeys, we have a quick “Getting Started” sequence that we’ve recently gussied up a bit. Check it out, and let me know what you think. (You can also pair it with our Allowance Launcher.) Regular newsletter readers know we often feature podcast guest shorts too. Here are a few highlights from recent episodes I don’t want you to miss. Joe Saul-Sehy: The “Circle Back” Technique Veronica Dangerfield: What should parents know about financial education? Kevin Kelly: Money as Gasoline If you like this content, then would you mind taking five seconds to subscribe to our channel?

Your subscribing actually matters a lot. More eyeballs there help us bring more interesting guests here. — 3 — Weekly Wisdom: “In other words, once you score big on a few investments in a row, you may be the functional equivalent of an addict—except the substance you’re hooked on isn’t alcohol or cocaine, it’s money.”

—Jason Zweig, Your Money & Your Brain

When money expert and parent Brad Klontz joined me on the podcast, he explained he introduced his son to investing at age seven: Brad, also a financial psychologist, was doubtless aware of how money can infect our minds, as Jason Zweig describes in the quote above. This addictive behavior is why his primary concern wasn’t that his son would experience a crushing loss; rather, it was that he’d see a massive gain. Fortunately, starting early allowed Brad to help his son cope with the psychological rapids we humans must navigate on the investing journey. I’ll have much more “kids and investing” information to share with you soon. My conversation with Evan Wilson, investing expert and emeritus host of The Money JAR Podcast, drops next month. Of course, you’ll find out all about it right here. Thanks for reading this week’s newsletter. And as always, don’t forget to enjoy the journey! John, P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being. View this email in your browser. Forwarded this email? Sign up here.

|