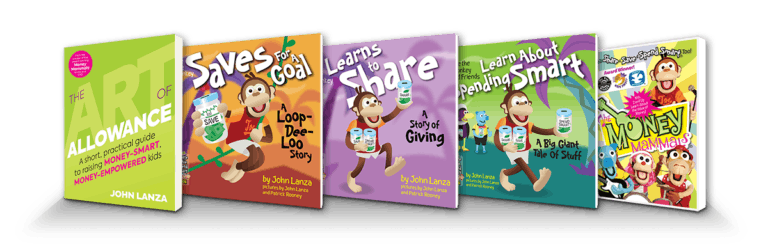

“Working to help parents raise money-smart kids.”

Hello, friends!

Sometimes you need to “flip the script” to bring new energy to an endeavor. I literally did that with Episode 059 of The Art of Allowance Podcast, which we released today. Because in this installment, it’s the guest asking the questions.

That guest is my sister, Kelly Mindell, creator of the influential Studio DIY brand that reaches over 700,000 folks in the social world. 🤯

Kelly, though, didn’t join me to ask about Instagram. Rather, she is a mom to six-year-old Arlo, whom she’s been raising using The Art of Allowance as her guide. 👏🏻

Kelly’s success comes in no small part from her ability to ask questions. (Lots of questions!) This skill has served her well in her business, and it’s why I’m confident she will be successful in raising a money-smart, money-empowered child.

Since Kelly began to quiz me about what she was doing with Arlo, I decided to change up the podcast’s format and have her ask the questions. And to make sure our conversation didn’t turn into a family reunion, I invited two-time podcast guest and author of The Wisest Investment: Teaching Your Kids to Be Responsible, Independent and Money-Smart for Life, Robin Taub, to provide additional perspective for Kelly, and, hopefully, you as well.

So without further ado, this week’s edition of “3 Ideas to Share & Save” features topics Robin, Kelly, and I discuss.

— 1 —

Get One. Give One. The pursuit of stuff often distracts us (and our kids) from what really matters. Despite our best efforts, toys, games, clothes and more tend to accumulate. They turn into piles. They eat up rooms. And before we know it, we’re completely overwhelmed. 😵💫

This dilemma can even occur if we’re intentionally working to minimize stuff. Try hosting a child’s birthday party and asking folks not to bring gifts. Social pressure rears its head! You know the feeling: When someone invites you to a backyard picnic and tells you not to bring anything, you don’t want to be “that guest” who’s the only one showing up with nothing.

There are, of course, workable solutions to this problem, like ECHOage, which Robin shares in our discussion. But social pressure is real and is just one way in which stuff amasses.

One bit of tactical advice to address this issue is the Get One. Give One. strategy. For every gift your daughter receives or for every piece of clothing she purchases, have her donate an old item. This strategy helps her begin to understand there’s a scarcity of space in her room or your home.

It also sets up the two of you for conversation. When your child wants to buy something at the store or save for what feels like yet another play set, you can ask, “What toy do you want to donate to make room for this one?”

Of course, if you feel strongly enough about this predicament, then podcast guest Josh Golin provides an entirely different perspective: Let people know that you’re raising your kids without commercialized toys.

— 2 —

Good Guidance: Robin does a nice job in her book of identifying the key ages and stages kids go through and how these milestones impact their developing money smarts.

In our conversation, Robin mentions that seven is “the age of reason.” Which means that Arlo, at age six, will need a lot of guidance since he has not yet reached his intellectual enlightenment (although he’s already a formidable LEGO builder and board game player). This observation also coincides with research I’ve cited before that kids can’t distinguish between marketing fact and fiction until they’re eight years old. 😳

As it turns out, Kelly was at our house last week to celebrate my daughter’s high school graduation. At dinner, Arlo charmingly remarked that a two-year-old friend of the family was “just a baby.” And he referred to himself as “almost a teenager.” It’s fun to witness how skewed young kids’ sense of time really is!

So when Kelly asks about how much guidance she should provide Arlo regarding purchasing decisions, I think Robin’s advice to offer a lot is insightful. Of course, as our kids get older and begin to pull away naturally, we do need to allow them to make their own mistakes. And we should be okay with these “low-stakes mistakes,” a term both Robin and I use and which I first heard from podcast guest and family finance researcher Ashley LeBaron.

When our kids are young, we need to repeat our guidance. Often. Like a great ad campaign, we want to get our message into their heads. In fact, it’s only when we feel like we’re too repetitive that we’re likely going down the right path. This is why we emphasize the purpose of an allowance over and over to our kids. They will only internalize a message when it’s repeated and, of course, they will only learn a message through their own experiences.

— 3 —

Turning Off the Money Spigot: During her podcast appearance, Kelly also shares a frustration you’ve likely encountered too: “His [Arlo’s] birthday party was on a Saturday, and my alarm went off on Sunday for his allowance. I thought, ‘Why am I handing over more money to this child?'” 🤔

Like I said, my sister likes to ask questions. Good questions.

So how do we turn off (or turn down) the money spigot?

Robin smartly suggests it might be time to set up an investment account for your child if he seems to be flush with cash. This tactic is in line with podcast guest Brad Klontz‘s advice as well, as he set up an investment account for his seven-year-old:

Frankly, when your kids are at this age, you may want to stash the majority of birthday cash. Although they should be a part of opening up those accounts, they don’t have to know exactly how much money you’re putting away. They’ll almost certainly not notice now, and they’ll be grateful later. In fact, our daughter was pleasantly surprised recently when she learned just how much her investment account had grown.

You might also take a tip from podcast guest Tabatha Thurman: She set up a “Family Jar” into which she, her husband and her child put money. (In Kelly’s episode, I refer to this as a “Vacation Jar.”) You could even use a goal-setting technique we’ve discussed before to create a S.M.A.R.T. goal, posting a picture of your family’s vacation destination. The Family or Vacation Jar concept is a wonderful way to get across the idea that you value time together over things. And if you match any money your child puts away, then she’ll see the power of the family working together.

Additionally, it’s okay to reduce your kids’ weekly allowance for a time. Remember your purpose: It’s to help them become money-smart and, eventually, money-empowered. One of the core money-smart skills you’re teaching them is to make smart choices with their money. So in this case, you’re modeling that choice.

Incredibly, I’ve only scratched the surface of the conversation Robin and I had with Kelly. So I’ll be back next week with more ideas for you to share and save.

In the meantime, don’t forget to enjoy the journey!

John, Chief Mammal

P.S. Please consult with a financial or investment professional before engaging in any decisions that might affect your own financial well-being.

Like what you just read? You can sign up for the newsletter here.